I’ve been sitting and waiting to buy more municipal bonds for my portfolio in my cash accounts for tax free income. With the administration pressuring the Fed to cut rates and the recent miserable jobs report, the Fed may finally start cutting rates so I’m pulling the trigger on buying some bonds before those sweet high interest rates disappear. Note that back in February, munis were paying 7 percent!

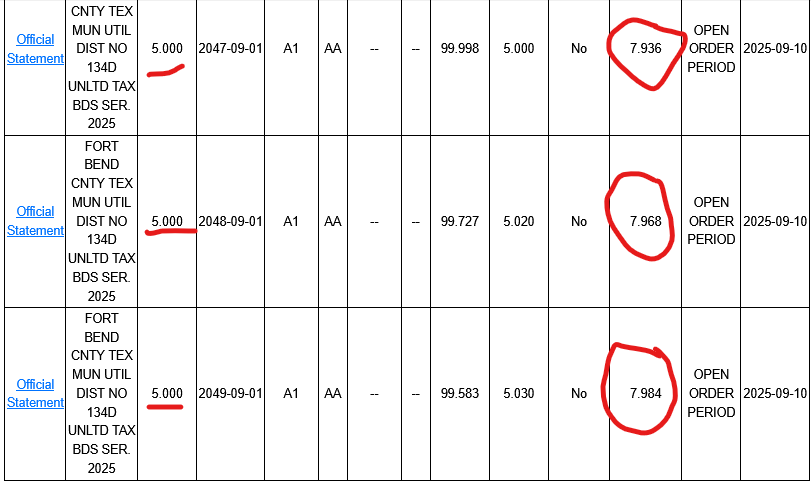

The latest notice I got this week from Fidelity had ~8 percent tax free equivalent bonds but the nominal interest is 5 percent.

These bonds are callable so I won’t likely bank the 8% for 25 years but if the Fed cuts rates the bonds will appreciate in value or I can hold until called or sell them for a premium before they are called.

The next Fed meeting isn’t until September so bonds coming out now until the Fed meeting *may* be the last window to get in on these for a while. If the Fed does cuts rates it may impact the US Dollar negatively as well so I am contemplating some hedges like I had before but I really want to load up on tax free bonds.

Share The Wealth

Are you buying bonds? Let me know in the comments below.

1 thought on “Municipal Bonds At 8 Percent Tax Equivalent Yield”

Comments are closed.