The past few days some digital currencies appear to be in free fall. The two I own are Bitcoin and Ethereum so you might think I’m quaking in my boots about losses on these two digital currencies but I’m not. I own these digital currencies through ETFs, IBIT and EHTA, and I specifically chose these ETFs over holding the currencies for one single reason: risk management.

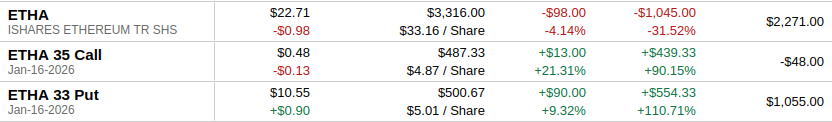

These two ETFs hold bitcoin and ethereum but the bonus with these ETFs is that you can trade options on them to hedge or risk manage your portfolio. Below are two examples of how I traded IBIT and ETHA and while we still have 58 days to go before we reach the conclusion of this hedged trade, it’s good to see today how these hedges work.

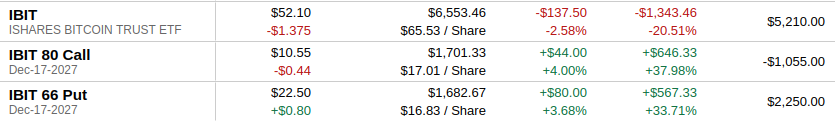

Bitcoin (IBIT)

The image above shows a trade on IBIT. A purchase of 100 shares at $52.10 ($5210) was executed along with a simultaneous sale of a Call contract for January 16, 2026 at the $67 strike for a premium of $6.89 (+$689). In addition a PUT contract for $6.37 for the $64 strike was bought for the same expiry. The PUT contract gives me the right to sell IBIT at $64 on January 16, 2026. If IBIT is $50 on Jan 16, I can exercise my contract and sell it for $64, limiting my losses to $0.65 x 100 = $65.

The net result of this trade was $6.89 – $6.37 = $0.52 net credit. 100 shares x $0.52 = $52. So if IBIT is below $64, I will have a total loss of $7 dollars vs $1465 if IBIT should close around $50 on January 16.

Ethereum (ETHA)

The image above shows another hedged trade. A purchase of 100 shares of ETHA was done for $3316 and a $35 CALL contract was sold for $487 and a PUT contract was bought for $501. The resulting loss here assuming ETHA is below $33 on January 16 would be around $4.87 – $5.01 – $0.16 = $0.30 x 100 = $30.

So grand total losses on these speculative trades would be $37 plus the time value of money but since interest rates have dropped that’s negligible.

The Show Ain’t Over

The show ain’t over yet, we have 58 more calendar days to go and it’s possible these digital currencies rally over that time window or they could drop further. The lesson here is that it’s entirely possible to limit your losses on sudden market moves through options hedging.

I hate losses but I won’t lose sleep over $37.

A Winning Trade

A much better trade happens when you go further out the expiry window. In the example above, a purchase of 100 shares at $65.53 along with the sale of a CALL contract for Dec 17, 2027 $80 strike for $17.01 along with a simultaneous purchase of a $66 put for $16.83. Note that in this example I bought IBIT at $65.54 but bought the right to sell it at $66 come December 17, 2027. This trade has a true net credit for the collar because there is no way to lose money on this trade. I bought at $65.54 and can sell at $66 and still made a profit on the options collar ($17.01 – $16.83) = $0.18 x 100 = $180. I have the right to sell it at $66 so $66 – $65.54 = $0.46 x 100 = $46. Total profit here is $226 minimum. We’ll need to wait till Dec 17 2027 to find out how high or low IBIT will go.

I have net credit collars on other ETFs including GLD and IWM and other securities. This won’t make me rich but it will limit losses and put some money in my pocket. Incidentally, the whole point of owning digital currencies in my overall portfolio also serves as a hedge for broader uncertainty of the US dollar and other currencies but that’s a post for another day.

Share The Wealth

Did you hedge before this market turbulence happening now? Let me know in the comments below.