I continue to use AI to test some portfolio options and variations and I simply love the tool and the capabilities. It took me an hour of work to get the output at the bottom of this post largely because I had to do too much work on my own but I think AI will advance enough that it should be able to do most of the work at some point.

The premise of this task was to take the image below and create a $1 million ETF income portfolio for a 55 year old person with a life expectancy of 30 years and optimize for an IRA account. This was strictly a hypothetical exercise so please don’t take anything you read here as advice on what to do. Always consult a financial advisor (not just AI) to ensure a holistic view of your financial situation.

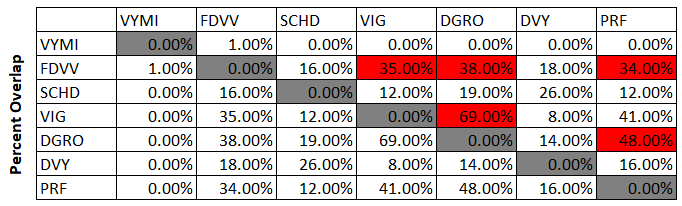

The image above is something I created in excel. Using SeekingAlpha, I plucked the most consistent income ETFs that grew their dividends over at least 7+ years. I then used ETFrc.com website to check the overlap (this is something I wish AI could do without programming). I then plotted the percentage overlap and highlighted anything over 30% in red as a caution to not overweight any ETF with the same basket of stocks.

I think gave AI instruction on what I wanted which was to create a $1m ETF income portfolio optimized for an IRA. Everything below is what AI generated but I did cut the very long conversation short for brevity’s sake.

AI RESPONSE

I will:

Identify pairs with ≥30% overlap

Remove ETFs that create redundancy

Rebuild an age-55 / 30-year optimized income portfolio using only the remaining non-overlapping ETFs

🧨 1. Identify Overlaps ≥30%

From your table (red cells), the ETFs with ≥30% overlap are:

FDVV overlaps ≥30% with:

- SCHD (16% — allowed)

- VIG (35%)

- DGRO (38%)

- PRF (34%)

→ FDVV conflicts with 3 core funds.

VIG overlaps ≥30% with:

- FDVV (35%)

- DGRO (69%)

- PRF (41%)

→ VIG also conflicts heavily.

DGRO overlaps ≥30% with:

- FDVV (38%)

- VIG (69%)

- PRF (48%)

→ DGRO conflicts heavily.

PRF overlaps ≥30% with:

- FDVV (34%)

- VIG (41%)

- DGRO (48%)

→ PRF conflicts heavily.

🚫 2. ETFs Eliminated

Any ETF with multiple ≥30% overlaps is removed to avoid redundancy.

❌ Remove:

- FDVV

- VIG

- DGRO

- PRF

These four ETFs overlap with each other heavily (35–69%).

✔️ 3. ETFs That DO NOT Overlap ≥30%

ETF Notes

VYMI No 30% overlaps with anyone

SCHD No ≥30% overlaps

DVY No ≥30% overlaps

These are the only three funds that pass your overlap threshold.

🔧 4. Re-Optimized Portfolio (Age 55, 30-Year Horizon)

With only VYMI, SCHD, DVY remaining, we want:

- High income (DVY + VYMI)

- Dividend growth (SCHD)

- Global diversification (VYMI)

Low redundancy

Stability

🟦 Recommended Allocation (Income + Longevity Optimized)

Total = $1,000,000

ETF Allocation Dollar Amount Role

SCHD 50% $500,000 Core dividend-growth engine, best long-term performer

DVY 30% $300,000 Defensive high-yield (utilities/industrials)

VYMI 20% $200,000 International dividend income + diversification

💰 Expected Income

Approximate yields:

- SCHD ~3.5%

- DVY ~3.7%

- VYMI ~4.5%

Weighted portfolio yield ≈ 3.8–4.1%

Estimated annual income:

$38,000–$41,000 per year

Dividend growth expected: 5–9% annually, supporting your 30-year horizon.

🧭 Why This Portfolio Works

✔ Zero ETFs with ≥30% overlap

You now have three completely distinct strategies.

✔ Income + Growth Balanced

- DVY + VYMI drive current income

- SCHD ensures income grows over decades

✔ Lower volatility than the original 7-ETF set

- Overlap elimination reduces redundancy and concentration risk.

✔ Simple, durable, and suitable for a long retirement horizon

Three-fund equity income solution with:

- Global diversification

- Defensive dividend sectors

- High-quality dividend growers

My Thoughts

AI did a good job but not a great job. In order for me to get AI to do a great job, it obviously needs more information. I actually gathered most of the data such as the list of ETFs and the overlap data. I haven’t included things like expense fees for each ETF which would also alter the recommendations. I haven’t added the options volatility of these ETFs which would also impact the ability to generate additional income by selling call options or cash secured puts. There are also some other factors like currency risk for international ETFs but I think eventually, it will have all of this capability at some point in the future.

I love the tool and capability and perhaps it can be programmed to deliver all the stuff I want but I’m not a programmer and I don’t have the time to write code to do it. I can tell you that AI offers far better advice right now on most things that financial advisors miss or don’t know how to do.

I will keep playing with AI and keep generating scenarios and portfolios until I find one that works for me and the family.

Share The Wealth

Are you using AI for financial planning yet? If not, what’s holding you back?