I use a few different tools to find net credit options collars for my stock holdings or if I want to initiate a new position and as I was walking someone through this process it occurred to me that Fidelity doesn’t make this easy so here’s a step by step way to navigate to the page to find options collars using Fidelity’s website. Fidelity has recently upgraded their website but the new design is inferior to the old design if you ask me so this requires going to the “classic” experience.

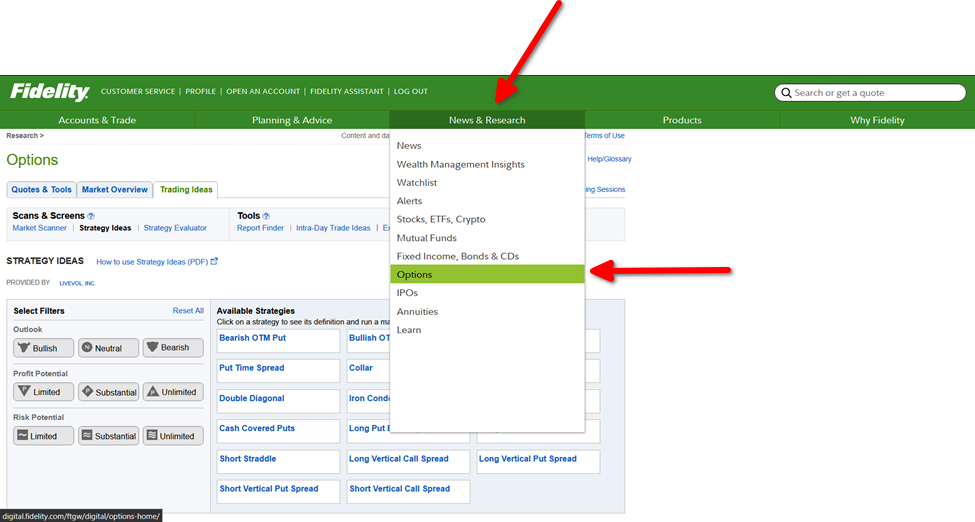

Step 1 is to log on to your Fidelity account and navigate to NEWS & RESEARCH at the main menu bar at the top and selection OPTIONS.

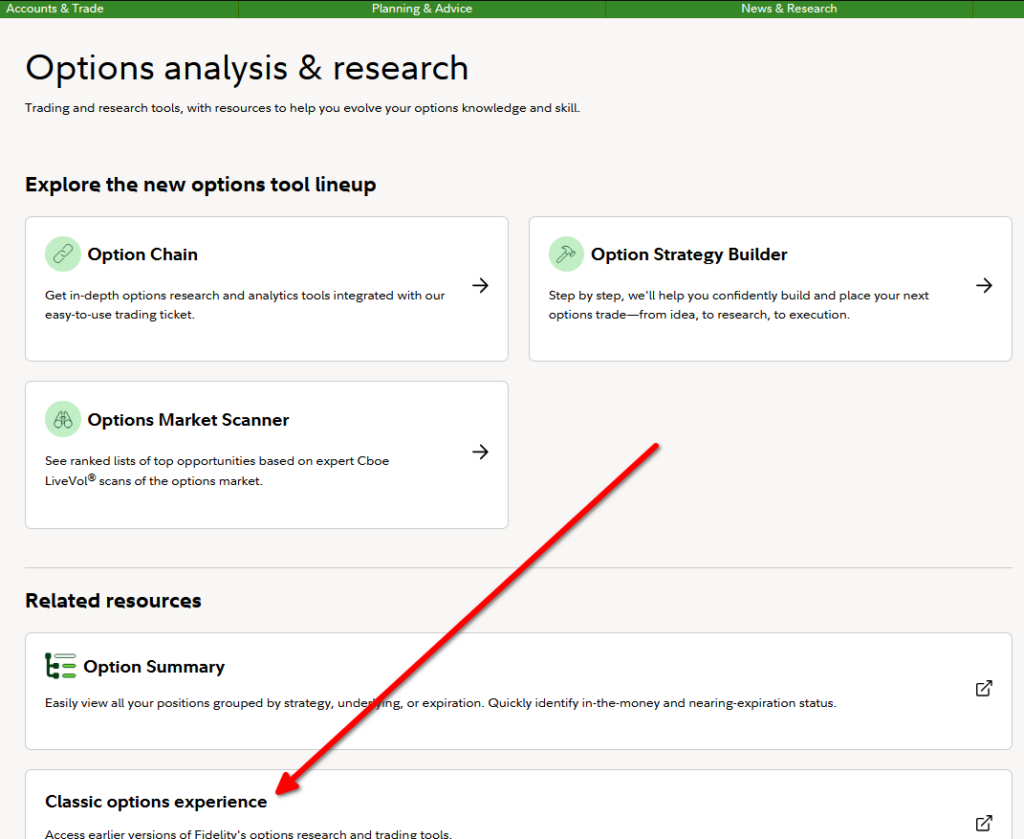

You should then see the screen below and you’ll need to scroll all the way down to select the “classic options experience” link.

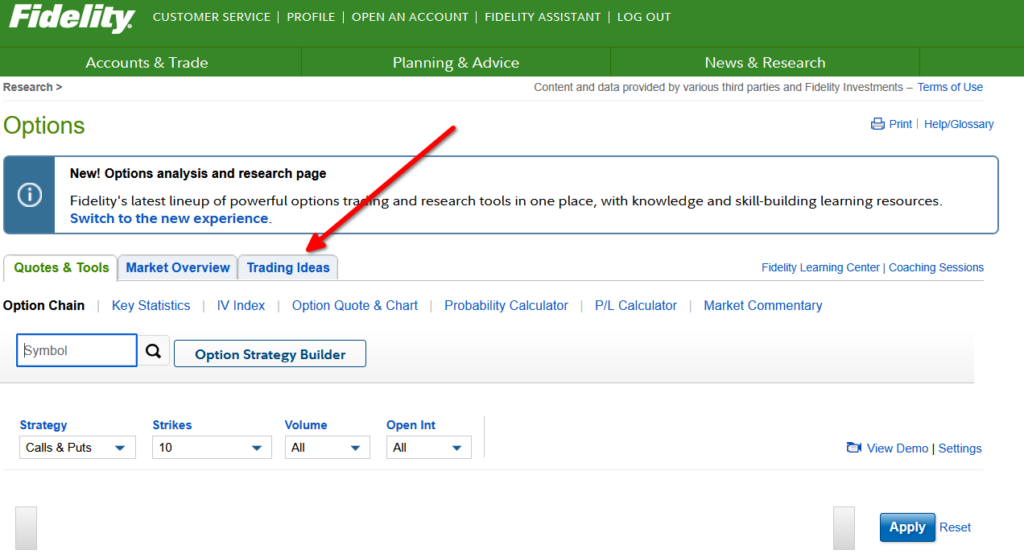

After that you will land at a page that looks like the one below, click “Trading Ideas” to get to the next screen.

You should then see the window below and you can click “Strategy Ideas”

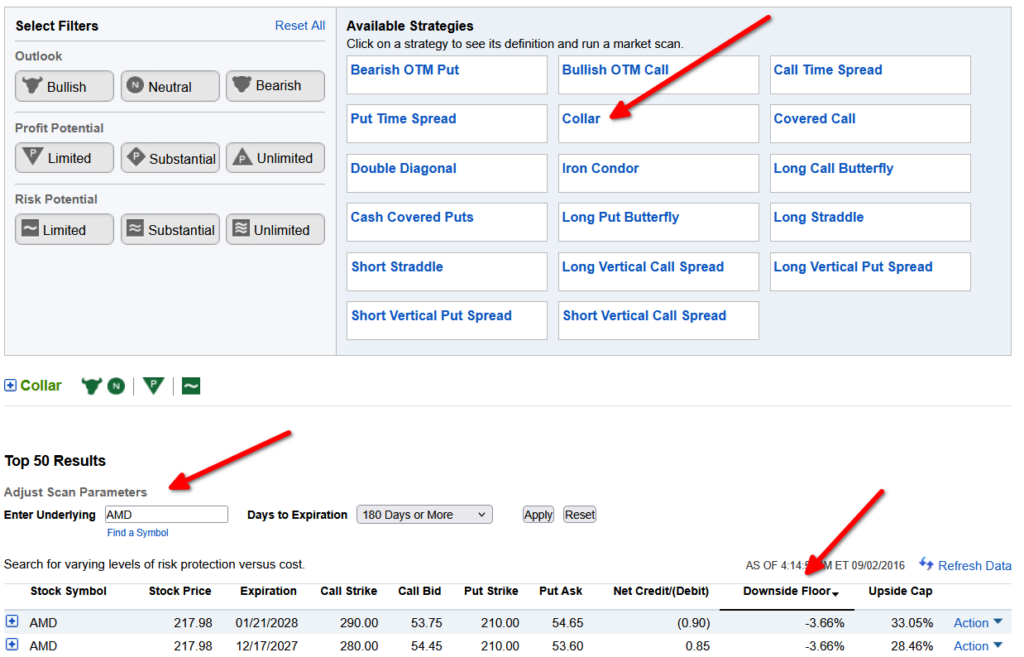

Next you will scroll around and find “Collar” and click on it then scroll down to see a tiny window where you can enter a ticker symbol for a stock you already own or a new one. I like to sort by Downside Floor and search for trades that have minimal or zero losses.

In the example above, I picked AMD, selected 180 days or more then clicked “Apply.”

The first two show options collars on AMD, the expirations, call strikes, put strikes and the spread. The downside floor shows you how much you would lose if the value of AMD goes below the PUT strike price and the upside cap is how much you’re capped should AMD rise above the CALL strike.

A 28.46% possible return for holding these options 2 years on AMD with a possible loss of 3.66% isn’t too bad but I prefer to have zero losses and shorter time frames, usually 6 months to 1 year max unless the option is 40% or more.

Other Tools

If you don’t have a Fidelity account, there are other tools some are free others cost money or require an acount.

For Schwab account holders, you’ll need to use ThinkorSwim platform which has a steep learning curve.

For E-trade/Morgan Stanley, you’ll need a subscription that may be free or for fee and use the E-Trade platform which also has a learning curve.

Share The Wealth

Do you have other tools you use to find options? Let me know in the comments below.