I’m so excited about my unfinished third app that I wanted to write a post about it! This is my first financial app that is centered around fixing a very annoying and time consuming problem I wrote about recently here. For some quick background, because the economy is spiraling downhill I’ve been trading net credit collars as one investment strategy and it’s also one recommended by AI as well.

The fundamental problem however has been finding ideal equities to trade net credit options collar on. Fidelity has a tool that allows you to search a ticker and check the options collars around them but it’s very time consuming to search ticker by ticker and check which one offers the best risk/reward ratio.

There are tools that help with a net credit collar search such as BarChart.com however they will give you a list of hundreds or thousands of equities and options so how to optimize the search better? Answer: AI!

AI App

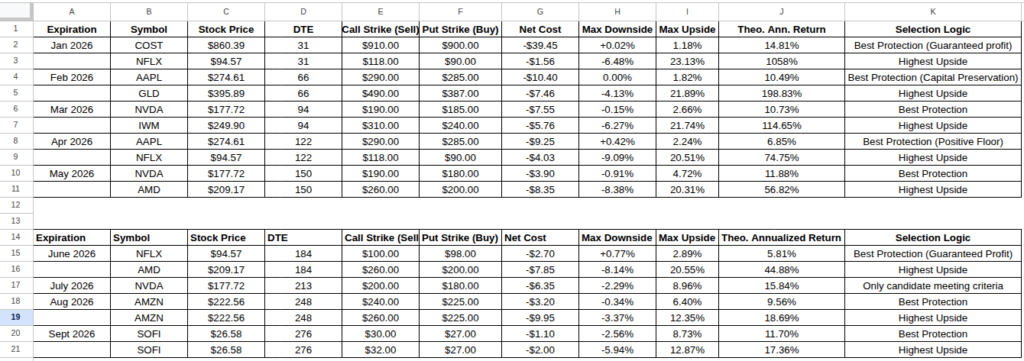

So I am building an app using Gemini that analyzes a data dump from BarChart that looks through hundreds/thousands of potential options trades and finds me the best ones based on parameters that I give it and voila! The google spreadsheet below is the semi-final product along with the explanation below. AI reviews the entire data stream, picks out one or two trades for each month based on optimum risk/reward.

Analysis of Selected Trades

Capital Preservation: Trades like COST (Jan), AAPL (Feb), and AAPL (Apr) are mathematically structured to have a “Max Downside” of ~0% or better (net of premium). This means if the stock crashes, your protective put and the credit received cover the loss.

High Growth Potential: NFLX and GLD offer substantial upside caps (20%+) but require you to accept a “deductible” (Max Loss) of roughly 4% to 9%.

Annualized Return Note: The annualized return for short-term high-upside trades (like NFLX in Jan) appears massive (>1000%) because the formula projects repeating that 23% gain every month for a year, which is theoretically possible but practically difficult.

June 2026 (NFLX): This trade stands out as an arbitrage opportunity (likely due to market data anomalies or wide spreads at the time of screening). It shows a positive downside, meaning even in the worst-case scenario (stock crashes), the protective put and premium received lock in a 0.77% gain.

August 2026 (AMZN): Offers a very conservative “Best Protection” option with only -0.34% risk, effectively preserving capital while offering ~9.5% annualized potential.

High Growth Options: The AMD (June) and AMZN (Aug – Strike 260) collars offer significant upside potential (20%+ and 12%+ respectively) but come with a higher “deductible” (Max Downside of -8% and -3%).

My Thoughts

Right now I am still doing a few steps manually but I am working on automating the whole thing so I can just review the summary list and pick what I want. Eventually I can envision AI doing these trades for me automatically and I just sit back and collect the profits.

Key issues for me:

- The dataset is huge – I had to break down the data into two files, one for 30 to 180 DTE options and the other for 180+ DTE which is why the image has a break in it.

- I checked the data against optionsprofitcalculator.com and it seems ok however until I actually execute a trade against this data it’s all theoretical.

Key Affirmations. You may notice something peculiar in the list that AI generated if you’ve been reading this blog for a while. I will give you a hint: IWM, NFLX, NVDA, GLD. I have been trading these tickers for months and this was way before I built this app. I just built this app this week and I was surprised to see tickers I have been trading a while on the list with AI affirming my strategy and it’s not my personal bias because I simply fed it raw data and I never mentioned my previous trades.

Update

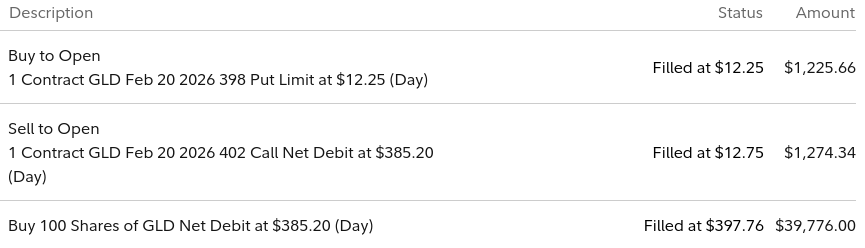

I wrote this post on Dec 16 and on Dec 17, I reviewed the recommended trades and took action and executed a trade. I did deviate from AI’s recommendation but I will track the difference to see if AI was smarter than I on this trade 🙂

AI recommended I sell the GLD Feb 16 $490 calls and buy the $387 Put which would lead to 21.89% return in 66 days (~200% annualized). I opted to be a bit more conservative and sold the $402 calls and bought the $398 put for a modest 1.8% return in 66 days (~10% annualized). I will follow up on Feb 16 to see if AI or I were right!

Share The Wealth

I ask again, have you picked out your AI ecosystem partner yet? If not, what are you waiting for? Don’t get left behind, I am already creating trading apps and cashing in and I know nothing!