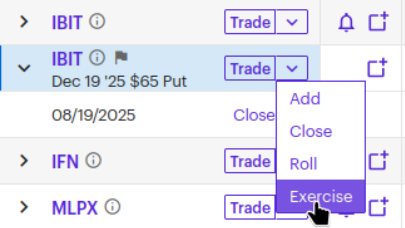

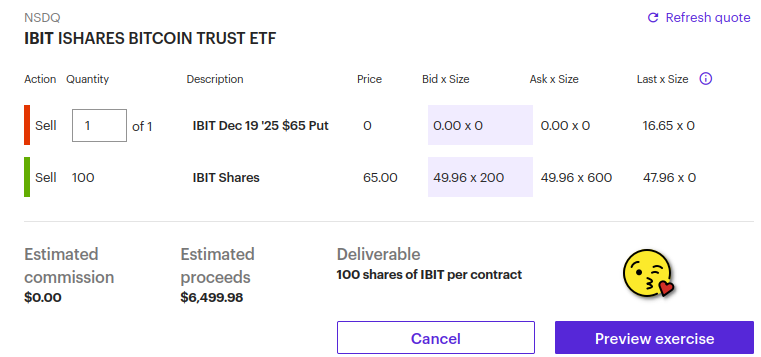

There are $7 trillion dollars in options expiring today. I sent the image below to my siblings about someone’s Christmas bonus going up in smoke as I exercised my put option and forced a margin call on someone out there in the world. They are going to have to cough up $6500 by Monday to fulfill their obligations.

This and similar trades are all part of using net credit collars to avoid or minimize losses. IBIT is currently trading at $49.75 and I am forcing someone to buy 100 shares at $65 so does that make me a Grinch?

Being On The Other Side

The way to avoid margin calls is to have sufficient capital reserves or shares and this week I was on the other side of the trade when someone forced me to sell 200 shares of IWM at $240 as it was trading near $250. I would have been on the hook for $48,000. I assume the trader wanted the shares to capture the dividend and the capital appreciation, it’s what I would have done if I had been on the other side of this transaction.

Margin Call Exposure

As of the end of today I have $450,000 in margin call exposure (CALLS) that’s all covered and I can force $181,550 in margin calls (PUTS) if I exercised them all however these are all spread out into the future so who knows that will happen.

Now that I have an app for net credit collars, I am thinking about creating a new app to optimize my margin exposure. So much to do so little time!

Share The Wealth

Do you have a tool for managing margin exposure? Let me know in the comments below!