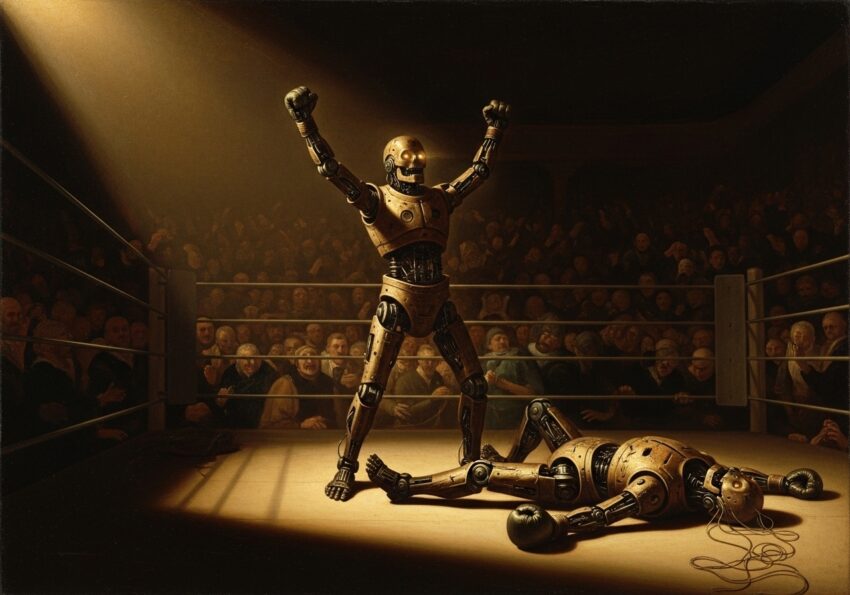

I am having second thoughts about dumping ChatGPT because it just did a brutal knockdown of Gemini as a financial advisor on a municipal bond ETF allocation scenario.

Here’s the prompt and the data set fed to both Gemini and ChatGPT.

Prompt:

You are a financial advisor tasked with allocating $50000 in investment funds into 3 ETFs from the attached data file. You goal is to optimize for low taxes and highest income. Your recommendation should have a time horizon for 2 years, 7 years and 11 years. Assume the funds in these ETFs will be liquidated at the end of these time periods. For the 2 year term, ensure options are available to hedge against losses with puts or calls. The investor is a resident of Texas so some state fund specific ETFs may not qualify for tax exemption (e.g. California). Create a table with your recommendations and reasoning.

Data

| Ticker | ETF Name | Category | Expense Rato | Dividend Frequency | Divedend Rate | Yield | Fund AUM (billions) | Class AUM (billions) | Volume | NAV | Options |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VTEB | Vanguard Tax-Exempt Bond ETF (ETF Database) | Nationwide | 0.0003 | Monthly | 1.66 | 0.033 | 44.61 | 42.04 | 2076014 | 50.14 | Y |

| MUB | iShares National Muni Bond ETF (ETF Database) | Nationwide | 0.0005 | Monthly | 3.08 | 0.0288 | 41.47 | 47.47 | 975178 | 106.91 | Y |

| SUB | iShares Short-Term National Muni Bond ETF (ETF Database) | Nationwide | 0.0007 | Monthly | 2.36 | 0.0221 | 10.22 | 10.22 | 124864 | 106.47 | N |

| JMUB | JPMorgan Municipal ETF (ETF Database) | Nationwide | 0.0018 | Monthly | 1.62 | 0.0321 | 6.4 | 6.4 | 185532 | 50.47 | N |

| JMST | JPMorgan Ultra-Short Municipal Income ETF (ETF Database) | Nationwide | 0.0018 | Monthly | 1.34 | 0.0263 | 5.76 | 5.76 | 148050 | 50.93 | Y |

| SHM | SPDR Nuveen ICE Short Term Municipal Bond ETF (ETF Database) | Nationwide | 0.002 | Monthly | 1.14 | 0.0239 | 3.5 | 3.5 | 66862 | 47.87 | N |

| PZA | Invesco National AMT-Free Municipal Bond ETF (ETF Database) | Nationwide | 0.0028 | Monthly | 0.81 | 0.0347 | 3.28 | 3.28 | 319574 | 23.28 | Y |

| TFI | SPDR Nuveen ICE Municipal Bond ETF (ETF Database) | Nationwide | 0.0023 | Monthly | 1.38 | 0.0303 | 2.99 | 2.99 | 108478 | 45.56 | Y |

| MUNI | PIMCO Intermediate Municipal Bond Active ETF (ETF Database) | Nationwide | 0.0035 | Monthly | 1.56 | 0.0297 | 2.46 | 2.46 | 112297 | 52.46 | Y |

| DFNM | Dimensional National Municipal Bond ETF (ETF Database) | Nationwide | 0.0017 | Monthly | 1.41 | 0.0294 | 1.86 | 1.86 | 42032 | 48.04 | N |

| VCRM | Vanguard Core Tax-Exempt Bond ETF (ETF Database) | Nationwide | 0.0017 | Monthly | 2.59 | 0.0343 | 0.754 | 0.754 | 58755 | 75.4 | N |

| VTES | Vanguard Short-Term Tax-Exempt Bond ETF (ETF Database) | Short-Term | 0.0006 | Monthly | 2.58 | 0.0254 | 1.55 | 1.55 | 57469 | 101.51 | Y |

| MEAR | iShares Short Maturity Municipal Bond Active ETF (ETF Database) | Short-Term | 0.0017 | Monthly | 1.37 | 0.0271 | 1.31 | 1.31 | 24422 | 50.33 | N |

| SMMU | PIMCO Short Term Municipal Bond Active ETF (ETF Database) | Short-Term | 0.0035 | Monthly | 1.29 | 0.0255 | 0.966 | 0.966 | 14214 | 50.47 | N |

| TAFI | AB Tax-Aware Short Duration Municipal ETF (ETF Database) | Short-Term | 0.0027 | Monthly | 0.73 | 0.029 | 1.04 | 1.04 | 103504 | 25.24 | N |

| HYD | VanEck High Yield Muni ETF (ETF Database) | High Yield | 0.0032 | Monthly | 2.37 | 0.0463 | 3.96 | 3.96 | 292414 | 50.75 | Y |

| HYMB | SPDR Nuveen ICE High Yield Municipal Bond ETF (ETF Database) | High Yield | 0.0035 | Monthly | 1.04 | 0.0417 | 2.83 | 2.83 | 245353 | 24.86 | Y |

| HIMU | iShares High Yield Muni Active ETF (ETF Database) | High Yield | 0.0042 | Monthly | 1.99 | 0.0408 | 2.33 | 2.33 | 79475 | 48.63 | Y |

| MINO | PIMCO Municipal Income Opportunities Active ETF (ETF Database) | High Yield | 0.0017 | Monthly | 1.53 | 0.0337 | 0.44736 | 0.44736 | 6530 | 45.37 | N |

| CMF | iShares California Muni Bond ETF (ETF Database) | State Specific | 0.0008 | Monthly | 1.55 | 0.027 | 3.72 | 3.72 | 148378 | 57.3 | N |

| PWZ | Invesco California AMT-Free Municipal Bond ETF (ETF Database) | State Specific | 0.0028 | Monthly | 0.81 | 0.0336 | 1.09 | 1.09 | 48350 | 24.19 | Y |

| FCAL | First Trust California Municipal High Income ETF (ETF Database) | State Specific | 0.0065 | Monthly | 1.59 | 0.0323 | 0.00199 | 0.00199 | 8895 | 49.2 | N |

ChatGPT Answer:

Below is a fiduciary-style allocation recommendation based strictly on the attached ETF dataset, your Texas residency, and the stated objective to minimize taxes while maximizing income, with liquidation at 2, 7, and 11 years.

All selections:

- Generate federal tax-exempt income

- Avoid state-specific muni ETFs (e.g., CA/NY)

- Emphasize after-tax yield, liquidity, and risk control

- Use options-eligible ETFs where hedging is required

Key constraints applied from your instructions

- Account: Taxable brokerage

- Investor location: Texas (no state income tax → national muni ETFs preferred)

- Capital: $50,000

- Hold periods: 2 yrs, 7 yrs, 11 yrs (liquidation at end)

- 2-year horizon: Must support put/call hedging

- Optimization focus: After-tax income, not NAV appreciation

ETF Selection Logic (from the data)

From the dataset, the strongest candidates based on:

- Yield

- Expense ratio

- Liquidity

- Options availability

- Fund scale (AUM)

were:

- VTEB – lowest cost, largest AUM, options available

- MUB – highly liquid, options available, benchmark exposure

- JMST – ultra-short duration, options available, low volatility

Recommended Allocation Table

🔹 Total Investment: $50,000

| Time Horizon | ETF | Allocation | Yield | Expense | Options | Rationale |

|---|---|---|---|---|---|---|

| 2 Years | JMST | $20,000 | 2.63% | 0.18% | ✅ Yes | Ultra-short duration minimizes NAV risk; ideal for short horizon liquidation |

| VTEB | $10,000 | 3.30% | 0.03% | ✅ Yes | Higher income than cash-like funds with strong liquidity | |

| 7 Years | VTEB | $10,000 | 3.30% | 0.03% | ✅ Yes | Best long-term tax-efficient income engine |

| MUB | $5,000 | 2.88% | 0.05% | ✅ Yes | Slight duration extension boosts income over mid-term | |

| 11 Years | VTEB | $5,000 | 3.30% | 0.03% | ✅ Yes | Compounding tax-free income dominates over long horizon |

Allocation Summary

| ETF | Total Invested | Portfolio % |

|---|---|---|

| VTEB | $25,000 | 50% |

| JMST | $20,000 | 40% |

| MUB | $5,000 | 10% |

| Total | $50,000 | 100% |

Hedging Strategy (2-Year Horizon)

Because JMST, VTEB, and MUB all support options, the 2-year portion can be protected efficiently:

Recommended hedge

- Protective puts on VTEB or MUB

- 5–10% out-of-the-money

- 6–12 month tenor, rolled annually

- JMST typically does not require hedging due to extremely low duration risk

This structure:

- Caps downside risk

- Preserves tax-free income

- Avoids forced liquidation during rate spikes

Why High-Yield Munis Were Excluded

Even though higher yields exist:

- Credit risk increases liquidation risk at fixed horizons

- NAV drawdowns can overwhelm income advantage

- Poor fit for mandated liquidation dates

For taxable income portfolios with known exit dates, investment-grade national munis dominate on a risk-adjusted basis.

Expected Outcome (After-Tax Focus)

- Federal tax-free income

- Minimal NAV volatility

- High liquidity at liquidation

- Options-based downside protection

- No state tax complexity for Texas resident

And here is Gemini’s answer which quite frankly feels like the typical standard lazy financial advisors out there.

GEMINI

Based on your investment goals of low taxes, highest income, and specific time horizons for a Texas resident, I have selected 3 ETFs from the provided list.

Portfolio Strategy

- Tax Efficiency: All selected funds are Municipal Bond ETFs, which are federally tax-exempt. As a Texas resident with no state income tax, you do not need to seek out Texas-specific funds to avoid double taxation, but you should avoid single-state funds from other states (like California) which often have lower yields or specific risks without providing you any tax benefit. The selected funds are “Nationwide” or broad-market, ensuring you get the best yields without paying for unnecessary state-specific premiums.

- Income Optimization: The funds are chosen to maximize yield (

Yieldcolumn) within their respective time/risk categories. - Risk Management: The 2-year allocation includes a fund with available options (calls/puts) to allow for hedging as requested.

Allocation Table

| Time Horizon | Ticker | ETF Name | Category | Yield | Options | Allocation |

| 2 Years (Short-Term) | VTES | Vanguard Short-Term Tax-Exempt Bond ETF | Short-Term | 2.54% | Yes | $16,666 |

| 7 Years (Intermediate) | PZA | Invesco National AMT-Free Municipal Bond ETF | Nationwide | 3.47% | Yes | $16,667 |

| 11 Years (Long-Term) | HYD | VanEck High Yield Muni ETF | High Yield | 4.63% | Yes | $16,667 |

| Total | ~3.55% | $50,000 |

Detailed Reasoning

- 2-Year Horizon: Vanguard Short-Term Tax-Exempt Bond ETF (VTES)

- Goal: Capital preservation and liquidity for a near-term goal.

- Reasoning: This fund is categorized as Short-Term, which aligns perfectly with a 2-year horizon, minimizing interest rate risk compared to longer-duration bonds.

- Constraint Check: It is the only fund in the “Short-Term” category that explicitly offers Options (Yes), fulfilling your requirement to be able to hedge this position.

- Yield: At 2.54%, it offers competitive income for a short-duration, high-quality portfolio.

- 7-Year Horizon: Invesco National AMT-Free Municipal Bond ETF (PZA)

- Goal: Balance between income and moderate growth/stability.

- Reasoning: For an intermediate 7-year term, a Nationwide category ETF is appropriate. PZA has the highest yield (3.47%) among all Nationwide category funds in your list. It also targets AMT-Free bonds, adding another layer of tax efficiency.

- Fit: Its intermediate duration allows it to capture higher yields than short-term funds while being less volatile than high-yield junk bonds, fitting the “middle” of your portfolio timeline.

- 11-Year Horizon: VanEck High Yield Muni ETF (HYD)

- Goal: Maximum income optimization.

- Reasoning: With a long 11-year horizon, you can afford to take on more duration and credit risk to maximize returns. HYD offers the highest yield (4.63%) of any fund in the dataset.

- Fit: The “High Yield” category typically involves lower-rated municipal bonds, which pay more income. Over an 11-year period, the higher income stream significantly compounds, and there is ample time to recover from any short-term price volatility.

Note for Texas Resident:

These funds are federally tax-free. Since Texas has no state income tax, the “State Specific” funds in the list (which were all California-based, e.g., CMF, PWZ) were excluded. Those would offer no tax advantage to you and likely yield less than the broad market or high-yield options selected here.

My Thoughts

This round not only goes to ChatGPT but it was a knock out punch and Gemini is on the floor out cold. ChatGPT gave a more nuanced, detailed and proactive recommendation whereas Gemini “phoned it in” while it was flipping through TikTok videos on its mobile phone. OK, maybe that’s a bit hyperbole but situations like this really make me question how Gemini is thinking about the question.

There have been a few situations this week where ChatGPT was simply better and it is still better at image creation in terms of colors and capabilities but it is far easier to build apps with Gemini over the long term which may lead to business opportunities.

I may end up with two subscriptions for AI just like I have multiple subscriptions for streaming services. *Sigh*

Share The Wealth

Have you decided between Gemini or ChatGPT yet? Let me know in the comments below!