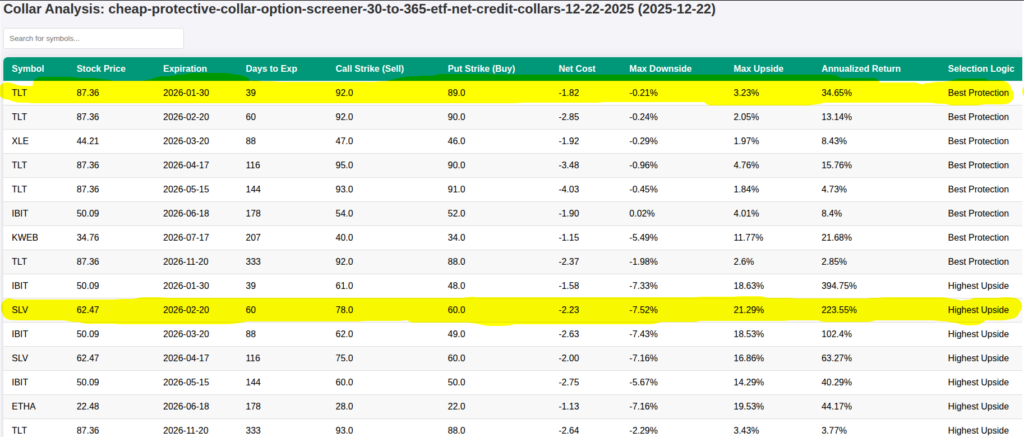

As I’ve written about creating a new app to help me find net credit collars on equities, I finally decided to trust AI with a couple of trades. Unfortunately the market isn’t static so what you see on a report is likely to change quickly.

I had expected to trade the items in highlight in the image below but the market moved too fast so I had to adjust my trade but kept the essence of the recommendation.

For TLT, the price dropped about $0.30 when I got ready to execute the trade at market open so I adjusted it slightly.

I normally don’t buy in-the-money puts but I understand what AI is telling me here. If TLT continues to drop, I can escape at a higher strike price than I bought it at but if TLT rallies and the put values drop, I make up for it in the calls at $91 strike. I am really curious to see how this will work out and TLT pays a dividend each month so I’ll capture that and then some type of premium yield.

On silver (SLV), I opted to do a buy-write instead of a net collar. Because SLV is a bit volatile, I may wait for the upswing in SLV to buy the puts further optimizing my profits. Technically, this isn’t an AI trade but AI did give me the idea of what to target.

I bought SLV at $61.12 and sold the $70 calls for February 20, 2026.

Both of options expire in February so I’ll write a follow up post to see how this pans out. Gold or fool’s gold?

Share The Wealth

Have you built an AI investor or trading partner yet? What’s holding you back? Let me know in the comments below.