The problem with living your life is that you don’t get to go back in time and correct your mistakes. What’s one problem I wish I could go back and fix? Contributing too much money to my 401k and not enough to non-tax deferred accounts.

My wife’s and my retirement accounts have ballooned into really nice nest eggs except the main problem is we can’t access the money without paying heavy tax penalties. First, there is a 10% penalty for early withdrawals before the age of 59 1/2 then the income is taxed as ordinary income so depending on your tax bracket and where you end up with the additional funds, it can be an additional 3 to 5 percent penalty on top. Worse yet is if you live in a state with a state income tax then you’ll have that to contend with as well.

If I could go back in time I would have contributed to my 401k up to the allowable matching funds then stashed away the rest of the money into a taxable brokerage account. I think the system is setup this way to keep people working right up to the point where they can’t or don’t want to work any more near 60 years old.

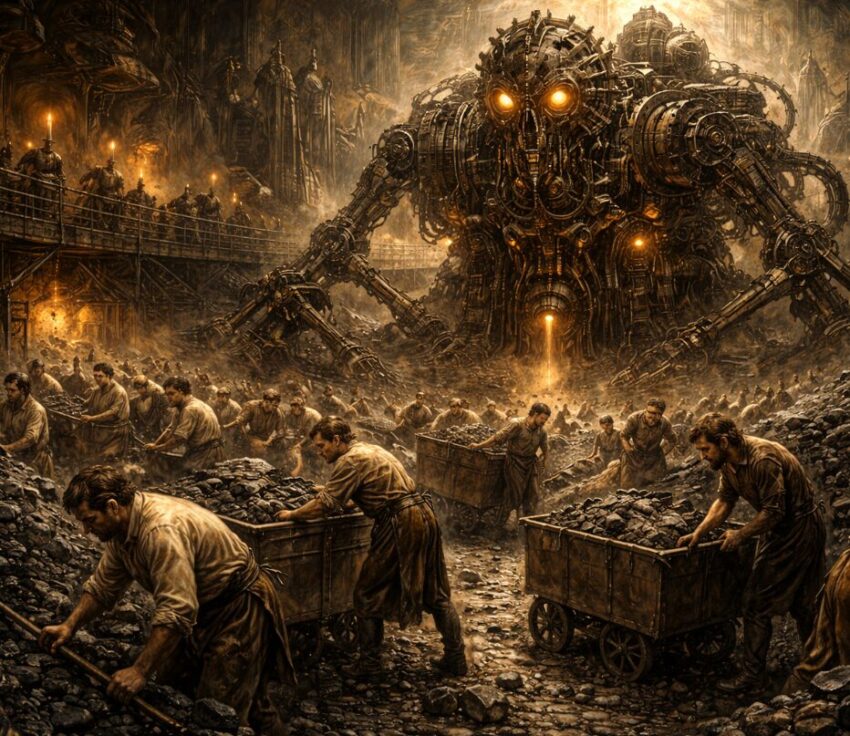

By the time you’re 60 years old, the best of you has been “squeezed” out and harvested by the machine we all work for in society. Sadly, many people are sick by this point and end up spending their nest egg on medical/healthcare and never get to enjoy life.

As 2026 begins I am looking forward to leaving the corporate world and living free but if I had to do it all over again I would change this one thing.

Share The Wealth

Do you think 401ks are a slave trap? Let me know in the comments below.