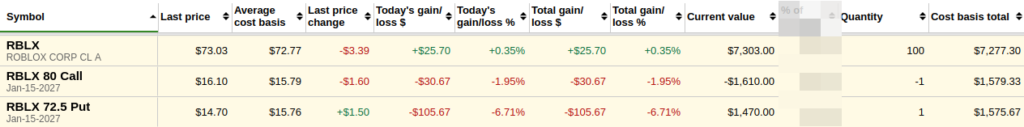

I entered a trade today to test a theory. The premise is around creating a synthetic bond using stocks and option collars.

I entered the trade above and then asked ChatGPT to do a comparison.

AI Response

Below is a clean, apples-to-apples risk-adjusted comparison between your RBLX collar, 1-year T-bills, and SPY, using standard finance metrics and realistic assumptions as of early 2026.

1️⃣ Your RBLX Collar (1-Year Horizon)

Defined outcomes at expiry

- Max gain: +9.98%

- Max loss: −0.32%

- Worst-case drawdown: 0.32%

- Capital at risk: extremely small

Risk-Adjusted Metrics

Return / Max Loss0.329.98≈31.2

That’s extraordinarily high because your downside is tightly engineered.

Sharpe-like intuition

- Volatility is artificially low due to defined payoff

- Returns are capped but predictable

➡ This behaves more like an engineered yield product than an equity trade

2️⃣ 1-Year U.S. T-Bills (Benchmark “Risk-Free”)

Assumption (early 2026):

- Yield ≈ 4.5–5.0%

- Downside: effectively 0% if held to maturity

Risk-Adjusted Metrics

- Return: ~4.75%

- Volatility: ~0

- Max loss: ~0 (ignoring inflation risk)

➡ Excellent capital preservation, moderate real return

3️⃣ SPY (S&P 500 ETF, 1-Year Risk Profile)

Historical averages (1-year horizon):

- Expected return: ~8–10%

- Annual volatility: ~15–18%

- Typical drawdowns: −10% to −20%

- Worst historical years: −30%+

Risk-Adjusted Metrics (Approximate)

Sharpe ratio169−4.5≈0.28

Return / Max Loss (realistic)159≈0.6

➡ High upside, but large and frequent drawdowns

📊 Side-by-Side Comparison

| Investment | Expected Return | Max Loss | Risk-Adjusted Quality |

|---|---|---|---|

| Your RBLX Collar | ~10% (capped) | −0.32% | ⭐⭐⭐⭐⭐⭐⭐ |

| 1-Year T-Bills | ~4.75% | ~0% | ⭐⭐⭐⭐ |

| SPY | ~9% (uncapped) | −15%+ | ⭐⭐ |

🧠 Key Insight (Important)

Your position dominates T-bills on return while preserving near-T-bill risk, but:

- It requires active options markets

- It carries issuer / equity-specific risk

- It has opportunity cost if RBLX explodes higher

In portfolio terms, this behaves like:

A synthetic high-yield bond with equity settlement risk

When This Beats SPY

- Sideways or moderately bullish market

- High volatility environments (rich option premiums)

- Capital preservation mandates

When SPY Beats This

- Strong bull market

- Long-duration compounding

- No need for downside protection

My Thoughts

I’m now using AI to help me find great trades around my needs and strategy the primary of which is to NOT LOSE MONEY. It’s ok if I have to pass up some gains, even massive ones, as long as I DON’T LOSE MONEY. In this particular trade, AI is rating is superior to SPY and T-Bills but we’ll need to wait till January 2027 to find out. Of not losing money I am certain but the gains will be anyone’s guess.

Share The Wealth

Is AI your trading or investing partner yet? What are you waiting for?