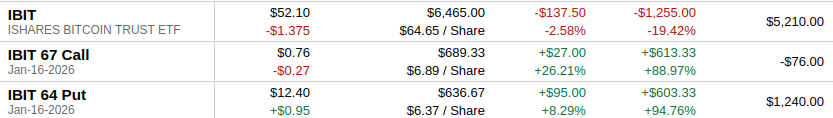

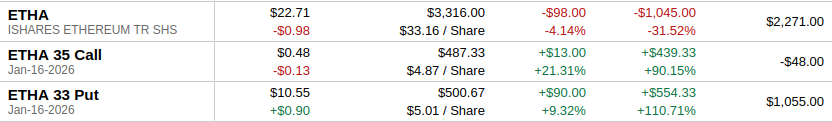

Not all trades are winners and that’s ok but the important thing is that your trades don’t lose you money and that’s the case today with Etherium and Bitcoin ETF trades I made a while back.

Options expiry is tomorrow and I had hoped these digital currencies might rally but it was a bridge too far so I decided to exercise my put options on these ETFs and minimized my losses to about $100 instead of thousands.

As I write this, ETHA is trading at $25.11 and IBIT at $54.74 but I sold them at $33 & $64 respectively.

Some poor guys out there will have to cough up $25,000 in margin calls today and I’ll be banking my capital. I have large call exposure tomorrow that will likely be exercised as all my calls are in-the-money so I will have a huge cash position that I’ll need to deal with on Monday. Note that I had other exercises on different brokerage accounts not just Fidelity.

About Fidelity & Options Exercises

Both Schwab and E-trade have a “exercise option” button on their trading platforms but Fidelity does not. You have to call them to exercise PUTS and this is annoying as heck. I don’t know if it’s because of Verizon’s outage but my call was dropped by Fidelity a couple of times and their Interactive Voice Response didn’t understand that I wanted to exercise my options. Worse yet, I had to be transferred from the person I finally was able to connect with and get transferred to their options “expert” to get this done.

If Fidelity doesn’t add the ability to exercise options on their platform by the end of this year, I may move my money elsewhere. It’s getting a bit more difficult for me to manage positions and margin across multiple-brokerage accounts and the reason I do it this way is because I don’t like having all my eggs in one basket.

Maybe it’s time for a new AI app?

Share The Wealth

Do you have a system for managing multiple brokerage accounts?