The title of this post is from a quote by Jeremy Irons in the movie Margin Call. In the scene (video below), Jeremy’s character, John Tuld, CEO of an investment bank sits at a conference room in the 2 am hours of the day trying to figure out what to do with a bond portfolio that’s about to blow up the firm.

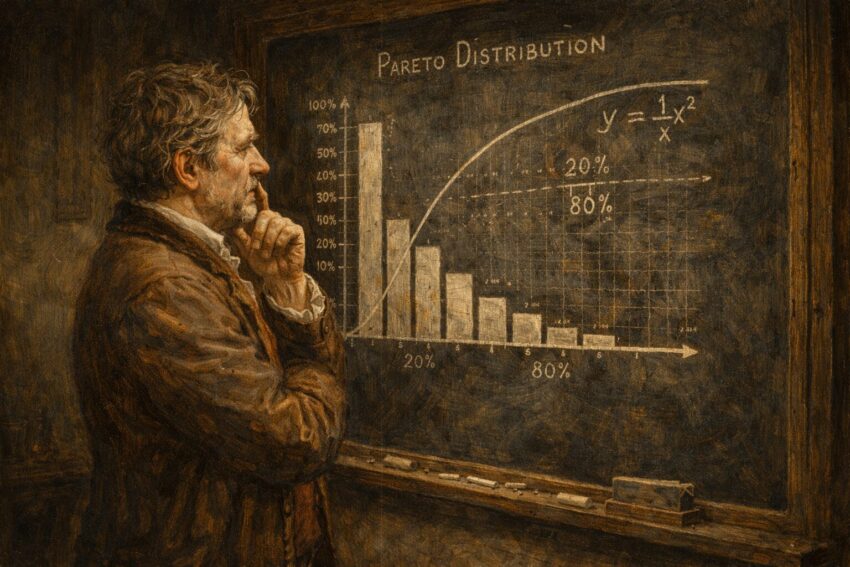

I thought about that scene when thinking about a recent re-visit to the Pareto Distribution on this post but I’ve written about the concept before here and here.

What keeps me coming back to this concept is that it permeates the entire financial world. The distribution is accurate and applicable to almost every part financial assets.

Precious metals? Take a wild guess where most of the money sits in precious metals.

Bonds? Take a wild guess where most of the bonds are that hold most of the money.

Stocks? Take a wild guess which stocks (ETFs) control most of the money.

Foreign Currencies? Take a guess which currencies account for 80% of global trade.

Real estate? Take a guess where 80% of the richest real estate sits in any city, state, country, part of the planet.

Over the years, I’ve tried investing in many different things but when I take a retrospective look it always seems to come back to the Pareto Distribution. There is a “natural” formation of monetary towers in the financial world.

It is well known that few financial advisors or money manager ever beat the S&P 500. When it comes to precious metals the bulk of money holds gold or silver despite other metals like Polodium and Rhodium which are more expensive still doesn’t attract as much money as gold or silver.

The bond market? Well the US has the most liquid and robust bond market in the world (for now) and the next set are dwarfed by the US bond market.

I’m embarking on a new journey using AI to find the best Pareto distribution investments in the world. I’ll share my findings at some point but I’m excited to repeat what’s worked for me in the US all over the world.

Share The Wealth

What do you think? Will Pareto Distribution rule the roost?