The administration signed a new rule around alternative investments in 401k’s today. The summary is below and I asked AI to give me a risk matrix for anyone considering adding speculation to your 401k.

Key Developments

President Trump signed an executive order on August 7, 2025, aimed at allowing alternative assets—such as cryptocurrencies, private equity, and real estate—to be included in U.S. 401(k) retirement plans.

What the Order Does:

Directs the Department of Labor to reassess ERISA regulations and clarify fiduciary duties for plan sponsors considering alternative asset allocations.

Requires coordination with the Treasury and the Securities and Exchange Commission (SEC) to update regulatory guidance, enabling inclusion of these non-traditional investments in defined-contribution plans.

Represents a rollback of previous restrictions or cautionary guidelines, including the May 2025 repeal of the Biden-era guidance that discouraged crypto in retirement plans.

Rationale & Market Reaction:

The goal is to diversify retirement portfolios and modernize investment options for approximately 90 million Americans managing over $9–12 trillion in defined-contribution assets.

Crypto markets responded positively: Bitcoin jumped roughly 2% to about $116,500, and Ethereum rose over 7% following the announcement.

Major asset managers like Blackstone, KKR, and Apollo could stand to benefit from accessing new capital flows into private markets.

Risks & Criticisms

Experts warn about exposure to volatile and illiquid assets, elevated fees, valuation transparency issues, and potential legal liabilities for plan sponsors.

Analysts expect slow adoption, as employers and retirement plan administrators will likely await clearer regulatory frameworks before offering these investments to employees.

Financial advisors emphasize the importance of investor education, adequate safeguards, and prudent counsel for participants navigating more complex retirement options.

Bottom Line

The executive order marks a significant policy shift toward expanding retirement investment options beyond traditional stocks and bonds. While it opens the door for mainstream inclusion of crypto, private equity, and real estate, adoption will depend heavily on how regulatory agencies, plan sponsors, and asset managers implement the changes—and whether sufficient protections are in place for everyday investors.

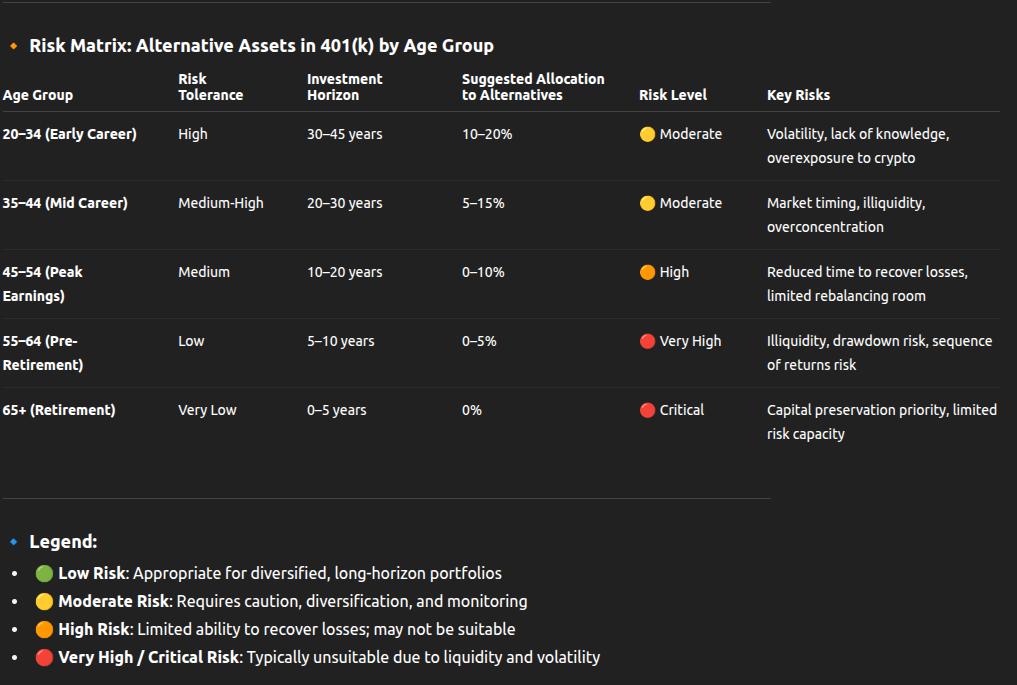

Risk Matrix (from AI)

I asked AI to give me a risk matrix based on age group and here is what it created: Risk matrix for incorporating alternative assets (e.g., cryptocurrencies, private equity, real estate) into 401(k) retirement plans, segmented by age group. The matrix considers investment horizon, risk tolerance, and portfolio flexibility across different age ranges.

Notes:

- Cryptocurrencies are highly volatile and speculative.

- Private equity and real estate are illiquid and may have long lock-up periods.

- Younger investors have more time to absorb losses and benefit from higher potential returns.

- Older investors prioritize capital preservation and stability.

My Personal View

I have a small amount of bitcoin in my investment portfolio and I may add no more than 3% of these speculative investments to my 401k but I have no immediate plans to do so. According to the chart, I should allocate up to 10% but I’m not so sure. The most important thing for me now is to simply keep my money and let it grow a little bit. I can’t really tolerate huge swings and I don’t need to as my wife and I have a sizable nest egg that should grow throughout our remaining life without speculative investments.

Share The Wealth

Are you going to gamble with your 401k? Let me know in the comments below.

I don’t like allowing more than 5% speculative investments in 401k plans. It seems we’re going in a direction with limited Social Security, so I don’t want people gambling to get rich with their retirement, which is supposed to be a security blanket. I’d much rather see 0% speculative investments in a 401k plan.

I think people should speculate with other money. We already have Peter Thiel with some many billions in untaxable money because he managed to put something like a bunch of PayPal stock in a retirement account at $0.0000003 a share. (Source: ProPublica story.)