I’ve been liquidating some of my stock investments because I don’t have a good feeling about 2026 and beyond but that doesn’t mean there aren’t potential opportunities out there to make money.

My two latest trades are net credit collaring SLV (Silver ETF) and NFLX (Netflix).

SLV (Silver ETF)

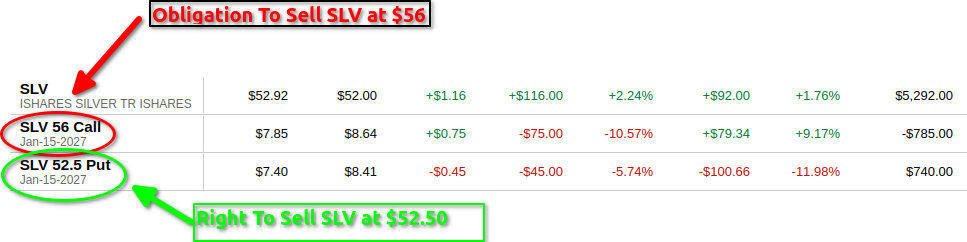

In the SLV trade, I bought 100 shares at $52 for $5200.

- I then sold the $56 call for for $8.64 giving me $864 in premium income.

- I then bought the $52.5 put for $8.41 costing me $841 in premium expense.

At this point, I have to wait till January 15 2027 . If SLV is at or above $56 on that day, I will be obligated to sell at $56 earning me about 8% return with no virtually no risk. If SLV is below $52.50, I can sell my shares at that price and recall that I bought them at $52 so I’ll make $0.50/share or $50 but I will obviously lose out on the 8% at $56.

I chose Silver because there seems to be an insatiable appetite for the metal. I still hold GLD (gold) collars as well that expire in January 2026.

NFLX (Netflix)

Netflix is highly volatile this week because of it’s intent to buy Warner so the options are nice and juicy. Like the trade above with SLV, I bought NFLX at $99.82, sold the $109 call for $14.10 and bought the put for $13.40. If NFLX ends up above 109 on January 15, 2027, I will make 9% return ($900) and if not, I’ll only keep the difference ($14.10 – 13.40 = $0.70 x 100 = $70).

There is nothing earth shattering here but I treat these trades like a 1 year CD with the potential to earn 9% or just get my money back.

Obviously, there are two small positions in the portfolio but in aggregate they earn thousands of dollars per month when done right and minimizes the risk of a bear market.

Share The Wealth

Are your risk managing your equity portfolio with a strategy? Let me know in the comments below.