The wonders of AI are only going to be limited by your imagination. I’ve been using AI for quite a few things now but it hadn’t occurred to me to use it as an auditor for my home and auto insurance policies until I saw this video from Coach Carson below.

Thanks for the idea Coach!

I decided to take my home insurance policy and have AI audit it for me from a consumer advocate point of view and it found some interesting things. Note: I removed all the personal information and policy number so if you do the same I suggest you strip out personal information. I also removed *some* information below such as the name of the insurance company and some of the financial numbers.

AI Audit of Homeowners Insurance Policy

Below is a consumer-advocate, insurance-expert review of your INSURANCE POLICY (Texas) based on the attached policy document “Home Insurance Redacted.” I focus specifically on coverage gaps, hidden limitations, and claim-impacting provisions that could negatively affect you as the policyholder.

Executive Summary (Plain-English)

This is a high-quality homeowners policy by market standards, but it contains several meaningful red flags that could lead to large out-of-pocket costs after a major loss, especially involving roof damage, water losses, code upgrades, mold, or catastrophes. The biggest risks stem from percentage deductibles, limited water/mold coverage, and coverage caps that sound generous but can fall short in real claims.

MAJOR RED FLAGS & CONSUMER RISKS

1. Percentage-Based Wind & Hail Deductible (Very Significant)

Deductible:

- 1% of Coverage A for windstorm or hail

- With Coverage A at $xxx,000, this equals a $x,840 deductible per claim Home Insurance Redacted.

Why this matters

- This deductible applies every time there is a wind or hail claim

- It is much higher than flat deductibles most homeowners expect

- Roof claims in Texas commonly fall into this category

Real-world impact

A $12,000 hail roof claim → you pay $x,840 before insurance pays anything.

Consumer takeaway:

This deductible alone can make many roof claims financially unattractive to file.

2. Roof Settlement & Aging Risk

- Roof installed: 20xx

- Composite shingle roof

- ACV Roof Credit is applied (signals reduced settlement value) Home Insurance Redacted.

Why this matters

Even with Platinum Choice branding:

- Older roofs are more aggressively depreciated

- Combined with a percentage deductible, many roof claims result in little or no net payout

Hidden danger:

You may technically have coverage, but practically self-insure roof damage.

3. Water Backup Coverage Is Severely Limited

- Water backup & sump overflow limit: $5,000

- Separate deductible: $500 Home Insurance Redacted.

Why this is a red flag

Typical sewer backup losses often exceed $20,000–$50,000 when:

- Flooring

- Walls

- Cabinets

- Electrical

are affected.

Consumer takeaway:

This limit is far below realistic loss scenarios and is one of the most common claim disputes.

4. Mold Coverage Is Extremely Narrow

Mold is excluded, except when:

- Hidden within walls/ceilings

- Directly caused by accidental water discharge

- Not related to seepage, long-term moisture, or maintenance issues Home Insurance Redacted.

Why this matters

Most real-world mold claims are denied due to:

- Timing disputes

- “Gradual” moisture arguments

- Maintenance exclusions

Result:

Cleanup, testing, and remediation costs often fall entirely on the homeowner.

5. Ordinance or Law Coverage Is Likely Insufficient

- Limited to 10% of Coverage A (~$48,400) Home Insurance Redacted.

Why this is risky

Modern building codes can require:

- Electrical upgrades

- Plumbing changes

- Structural modifications

- Energy compliance

In total or major losses, 10% is frequently inadequate, especially in older homes.

6. 130% Replacement Cost Has a Hard Ceiling

You have:

- 30% additional dwelling coverage endorsement

- Maximum payout capped at 130% of Coverage A Home Insurance Redacted.

Why this matters

- Reconstruction inflation

- Labor shortages

- Catastrophe demand

These can push rebuild costs well beyond 130%, leaving you underinsured after a total loss.

7. Personal Property Sub-Limits Are Low

Despite “Platinum” branding:

- Jewelry theft: $1,500

- Firearms: $2,500

- Business property (home office): $2,500 on-premises

- Electronics in vehicles: $1,500 2Home Insurance Redacted.

Consumer risk:

High-value items require separate scheduling or they are underinsured by default.

8. Claims Filing Deadlines (Texas-Specific Trap)

- Wind/hail claims must be filed within 1 year, unless “good cause” is proven

- Lawsuit limitations can expire before homeowners realize disputes exist Home Insurance Redacted.

Why this is dangerous:

Delayed roof damage discovery is common — late filing risks total denial.

9. Flood Is Completely Excluded

- Flood damage is not covered, even if caused by hurricane-related rain or surge Home Insurance Redacted.

Consumer reality:

Many homeowners mistakenly assume wind-driven flood is covered — it is not.

POSITIVE FEATURES (FOR BALANCE)

✔ Replacement cost on personal property

✔ Higher liability limits than standard policies

✔ Collapse coverage broader than basic HO-3 forms

✔ Identity theft coverage included

✔ Loss of use coverage reasonably defined

These are good, but they do not offset the major loss exposures above.

OVERALL RISK RATING (Consumer Perspective)

Coverage Quality: ★★★★☆

Claims Practicality: ★★☆☆☆

Catastrophe Protection: ★★☆☆☆

➡ Strong on paper, risky in real-world Texas losses

CRITICAL QUESTIONS YOU SHOULD ASK AMICA OR YOUR AGENT

- Can the wind/hail deductible be converted to a flat dollar amount?

- Is ACV roof settlement mandatory due to roof age?

- Can water backup coverage be increased to $25k–$50k?

- Are higher ordinance & law limits available?

- Should key personal property be scheduled separately?

- What triggers non-renewal after roof claims in Texas?

Final Consumer Verdict

This policy is better than average, but not as protective as the “Platinum” label suggests. Without adjustments, you face meaningful financial exposure in the exact scenarios most Texas homeowners experience: hail, water, and reconstruction inflation.

AI Fight Club

I fed the exact policy and prompt to both ChatGPT and Gemini and got more detailed information from ChatGPT but essentially the same information. I call this round a draw although ChatGPT was more thorough, Gemini gave me actual sentences to use with my insurance company on specific deficiencies and my prompt did include a command to act as a consumer advocate for the policy holder which Gemini did but to be fair ChatGPT asked if I wanted it to give me some recommendations as a follow up.

When I asked for the recommendations, ChatGPT gave me some valuable ones:

- Switch from using credit card to paying with bank draft to save 5%

- Update dwelling limit+deductible impact

- Check roof install/repair dates

My Thoughts

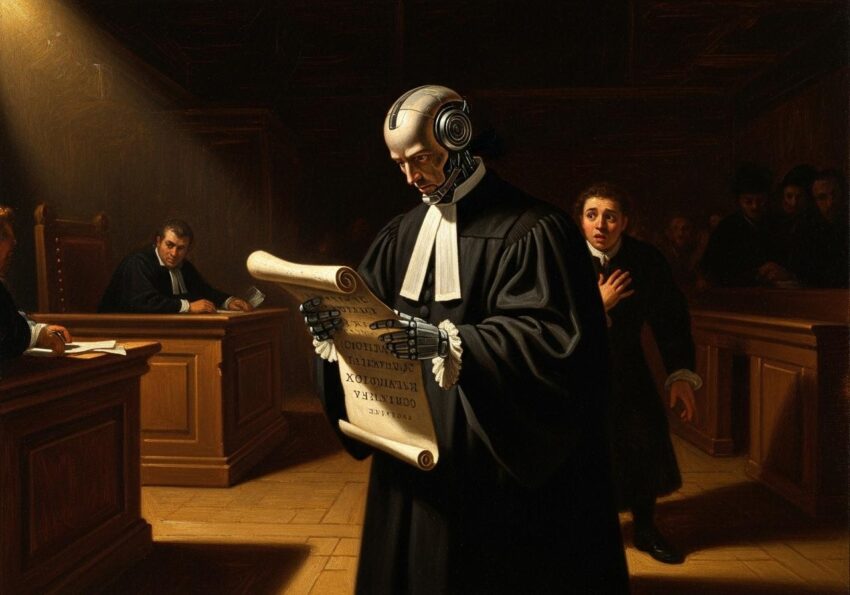

I already took action and fired off an email to my insurance company with a variety of questions and am awaiting the answers to adjust accordingly. If I don’t like the answers or costs, I will start shopping around. It is great to have my own AI insurance “lawyer/advocate/agent” for the low low cost of $20/month and if it is already making me act, image what will happen to the insurance industry in a few years.

Share The Wealth

I ask again, have you picked out your AI ecosystem partner yet? If not, what are you waiting for? Don’t get left behind, I already have AI acting as my insurance lawyer/advocate/agent giving me the best advice and championing for my family. What have you got?