On of my “secrets” to eating out cheaply has been to visit overlooked ethnic restaurants in my city. I am blessed to have access to many different types of cultural restaurants and one of the place recently visited is one in which I keep detailed receipts because what we order is not actually on the menu so I have to keep receipts of what our guide orders so I know what to order next time. I wrote about this before in “My Secret To Cheap Restaurants Eats” last year.

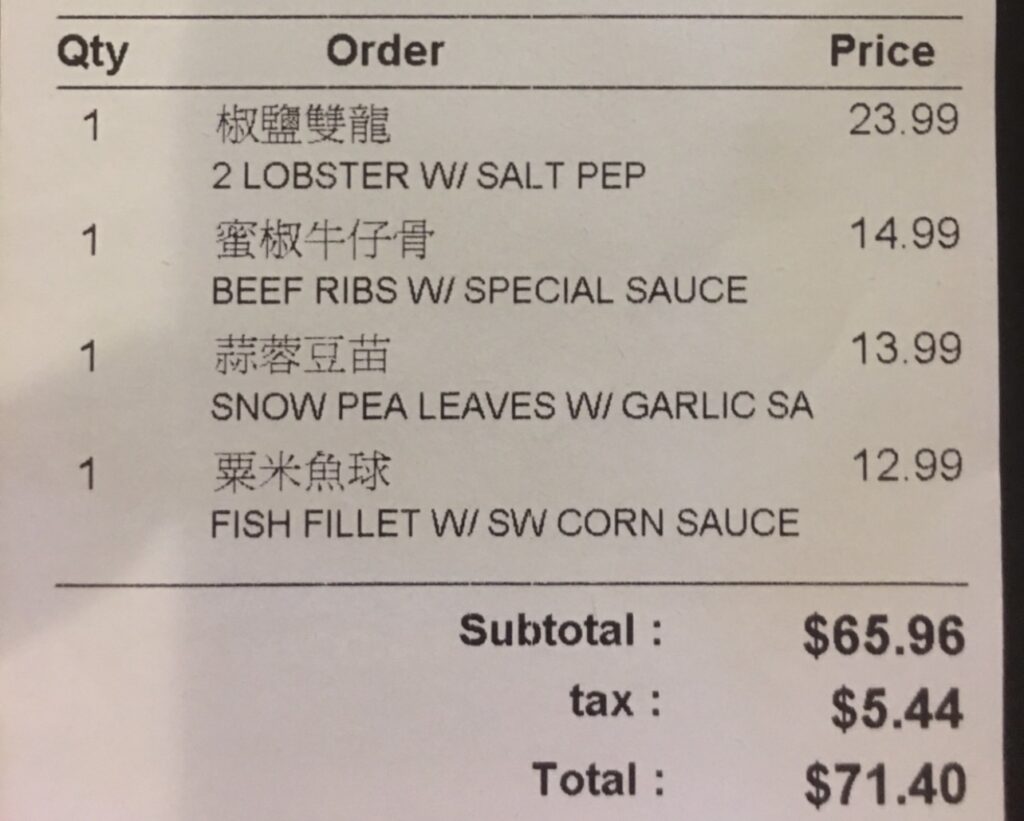

The “cheap” eats may not be so cheap any more but I continue to be flabbergasted by the rate of inflation for eating out. The first receipt below is from 2017 for four food items.

The second receipt if from December 2025 for the same items sans snow peas.

From 2017 to 2025 the cost of the items:

- Lobster from $23.99 to $33.00, an increase of 37.56 percent!

- Beef ribs from $14.99 to $19.99, an increase of 33.36 percent!

- Fish Fillet from $12.99 to $14.99, an increase of 14 percent!

An average of 28 percent in price increases for all items. The items served are family style and it could feed about four people. Had we ordered the snow peas as well, it would have been about $100 or a little over. Gratefully, with me taking Zepbound and hardly being hungry, we did without the snow peas and we actually had food left over to make another meal for one person but the increase in cost is frightening.

I say frightening because inflation is something people have very little control over. Inflation isn’t so terrifying if you are working an earning increases in pay but retired people often don’t have that luxury. We are reaching a point where the United States is going to have 80 million or more people on social security by 2030 mostly living off fixed income. If you are on fixed income, you aren’t going to have extra money lying around to pay for 30% increases in food costs.

We have already crunched the numbers and despite having millions in the bank, it is likely we may go bankrupt if we stay in the U.S. when we retire. What makes more sense for us is to live overseas for a decade or longer at a much lower cost country and let our investment portfolio grow multi-fold then return if it makes financial sense.

If we remain in the United States, it is clear that health insurance, property taxes, food costs, utility costs, and other expenses will eat us alive. Sure we might be able to survive but every year our quality of life will be reduced to pay for rising expenses. Instead of taking 4 or 5 trips abroad, we would probably only be able to do 1 or 2. Instead of spending 30 or 60 days abroad, we’d spend two weeks or less. Instead of staying at very nice hotels, we’d have to stay at cheaper places.

And the most terrifying thing of all would be a catastrophic illness that bankrupts us because health care in America is a bankruptcy death trap.

The central bank cut interest rates this month and the current administration wants rates cut further which will lead to an explosion of inflation. We may be in for another cost conundrum soon enough.

Share The Wealth

Do you have a plan for even higher inflation?