I don’t know how Quicken/Intuit will survive, in less than an hour, I built my own financial dashboard and credit card spend and rewards dashboard and it did everything right whereas Quicken made endless errors last time I used it.

Financial Dashboard

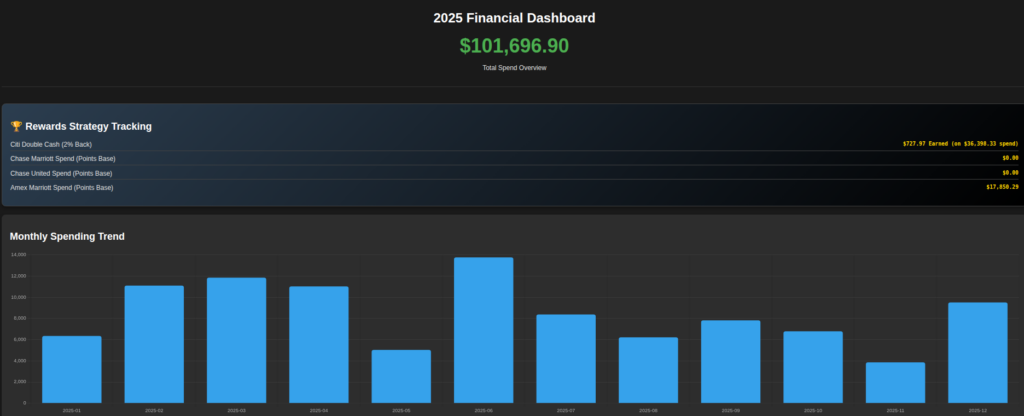

I have a ton of bank accounts and getting a full picture of all of my activity has never been easy so I decided to try to do something about it. I downloaded all the transactions from all the major institutions I use and asked AI to build me a financial dashboard. Based on the analysis, I made $58k in income (dividends/interest) and $20k from options trading. Note that I did not put ALL my financial accounts in here just the ones with lots of trading activity that I lost track of in 2025. I plan on building something like this for my rental properties too but that’s fairly consistent except for the maintenance surprises. Note that I blurred some things out purposely (it’s not an error) and it’s a long HTML dashboard with drilldowns but below are screenshots.

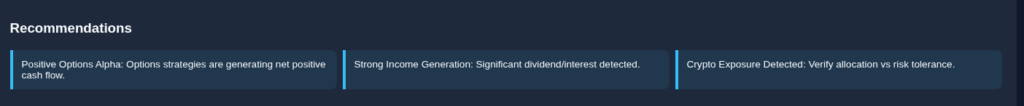

AI analyzed all my transactions, told me how much income I generated from the portfolio and how much came from options trading. It created drill-down areas for further analysis and it did all of this in minutes by sorting through hundreds of transactions from multiple institutions. To boot, it gave me some recommendations from the portfolio.

Credit Card Dashboard

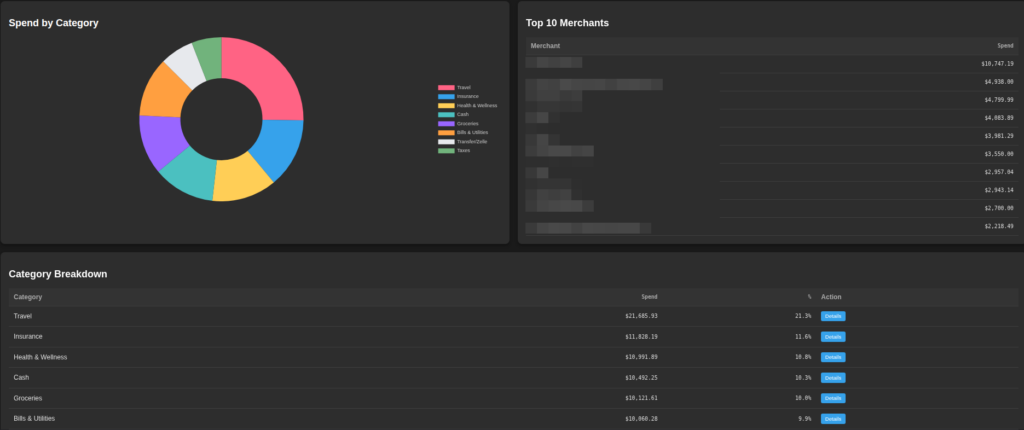

After I setup the financial dashboard I started thinking about my spend so I had AI create me a spend dashboard then it occurred to me to ask it to create an analysis on my spend and tell me how I can optimize my rewards with credit cards. As you may recall, I travel a great deal and like to use hotel and airlines points to travel for free and/or upgrade to business class on air travel or other perks.

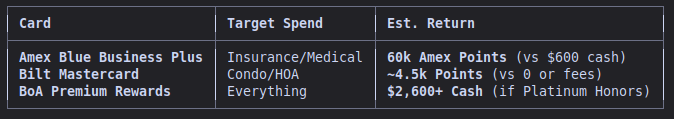

Below is the analysis from AI on which cards I should dump and which ones I should sign up for in 2026!

Analysis & Recommendations

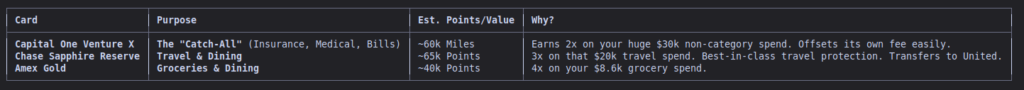

Your current setup (Citi Double Cash + Chase/Amex Hotel/Airline cards) is good but optimized for specific brands rather than flexible travel power or maximizing your largest spend bucket (Insurance/Medical).

- The “Non-Category” Monster: Insurance & Medical ($30k)

You are spending ~$30k/year on Insurance, Medical, and Bills. Most travel cards earn only 1x points here.

- Current: Citi Double Cash (2% cash back) = $600/yr.

- Missed Opportunity: A card that earns 2x transferable points (Capital One, Amex Blue Business Plus) could turn this into 60,000 miles, which is often worth more than $600 if redeemed for international business class flights (valued at ~$1,200+ by TPG standards).

- Recommendation:

- Capital One Venture X: Earns 2x miles on EVERYTHING.

- $30k spend = 60,000 miles.

- Plus, it covers your travel perks (Lounge access, $300 travel credit).

- Chase Freedom Unlimited: Earns 1.5x points on everything. If you have a premium Chase card (Sapphire), these points transfer to United/Hyatt.

- Capital One Venture X: Earns 2x miles on EVERYTHING.

2. Travel Spend ($20k)

You are heavy on United and Marriott.

- Chase Sapphire Reserve (CSR):

- Earns 3x on Travel (after $300 credit).

- $20k spend = 60,000 Chase Ultimate Rewards points.

- Why: You can transfer these 1:1 to United (your preferred airline) or Marriott (though Hyatt is better value).

- Perk: Better travel insurance than airline co-branded cards.

- Amex Platinum:

- Earns 5x on Flights booked directly.

- If your $20k travel is mostly flights, this earns 100,000 points.

- Downside: Weak earnings on hotels (unless booked via Amex portal) and terrible on insurance/medical (1x).

3. Groceries ($8.6k)

- Current: Likely 1x or 2x depending on card.

- Recommendation:

- Amex Gold Card: Earns 4x points on Groceries (up to $25k/yr) and Dining.

- $8.6k spend = 34,400 Amex Membership Rewards points.

- Value: ~$680 (at 2 cents/point).

Proposed “Trifecta” Strategy

To maximize your specific mix of High Travel + High “Boring” Spend:

Estimated Total Annual Value: ~165,000 Premium Points (approx. $3,300 value for travel) vs. ~$2,000 if you stuck to straight 2% cash back.

Next Steps

- Check Capital One Venture X: It effectively creates a “floor” of 2% value for travel on your insurance/medical bills.

- Evaluate Chase Sapphire Reserve: Since you already fly United, pooling points here is powerful.

✦ Based on the data, here are three “Next Level” recommendations to further optimize your setup, specifically targeting the unique aspects of your spending:

- The “Hidden” Business Card Strategy (For the $30k Misc Spend)

You have ~$30k in “boring” spend (Insurance, Medical, Utilities) currently earning ~1-2%.

- Recommendation: Amex Blue Business Plus.

- Why: It earns 2x Membership Rewards points on all spend (up to $50k/year) with NO Annual Fee.

- The Play: You don’t need a formal corporation; a “Sole Proprietorship” (using your name) qualifies. This card generates 60,000 points on that $30k spend, keeping everything in the Amex ecosystem with your Marriott card.

2. Rent/HOA Optimization (For “Condo”)

I see recurring payments to CONDO (~$370/mo or more).

- Recommendation: Bilt Mastercard.

- Why: It is the only card that lets you pay Rent/HOA with no transaction fees while earning 1x points.

- The Play: Bilt sends a physical check to your HOA/Landlord, charging your card. You earn points transferable to United (rare!), Hyatt, or Marriott.

3. The “Cash King” Alternative (Bank of America)

If you have $100k+ in assets with Merrill Lynch or Bank of America (checking/investing):

- Recommendation: Bank of America Premium Rewards.

- Why: With “Platinum Honors” status, this card earns 2.62% cash back on EVERYTHING and 3.5% on Travel/Dining.

- The Play: This beats the Citi Double Cash (2%) and even the Venture X (2x) for pure guaranteed return on your high Insurance/Medical spend.

My Thoughts

I think it did a great job of analyzing my spend and giving recommendations, I was already thinking of signing up for the Chase Sapphire Reserve card in 2026. I don’t bank at Bank of America but I know people who do and they could probably benefit from the cash back program mentioned here that I was not aware of. The broader issue however is how anyone can now build their own custom “Quicken” or financial dashboard, credit card spend dashboards and more. The only limitation is your imagination and AI’s capacity to get it to do what you want so why should Quicken/Intuit continue to exist? My next experiment is to feed AI my tax documents and tell it to optimize it for me. If it does a good job, why do I need TurboTax? I am sure AI can fill out all the tax forms.

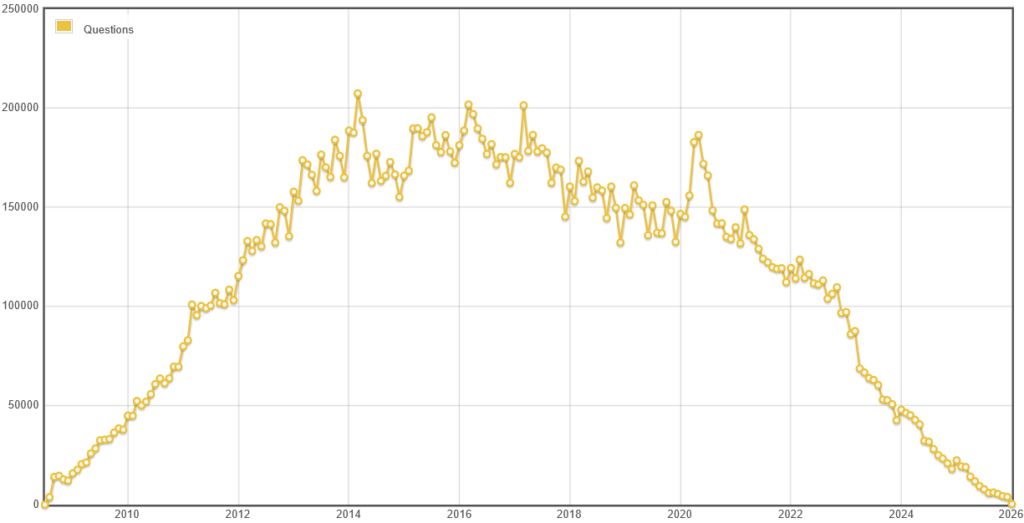

I ran across an article discussing how a website named StackExchange has gone from 500,000 users asking questions each month to nearly zero. Is this the future of most firms making money off “information” or data?

If you want another example, look at TTEC, which was mentioned on CNBC today at PowerLunch. AI is decimating the need for call centers with chatbots, the stock chart looks like the patient is flat-lining.

Share The Wealth

Are you amazed by all of this yet? Are you terrified yet?