When it comes to money, Warren Buffet is probably one of the most quoted individuals and the one quote I see over and over again with regards to money is this one: “The first rule of an investment is don’t lose [money]. And the second rule of an investment is don’t forget the first rule. And that’s all the rules there are.”

In another post entitled, The Odyssey To Multi-Million Dollar Portfolio, I told you about how it took decades to go from minimum wage to millions and I certainly don’t want to go back to the daily struggles of my youth so Warren’s message resonates with me very well.

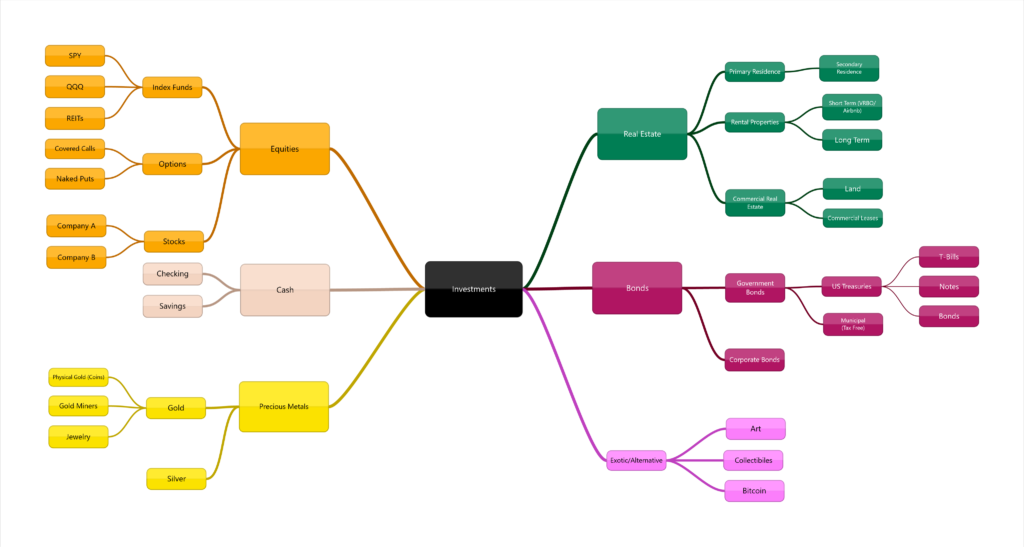

One of the most important thing to do when you have millions of dollars is to manage risk. There are many different frameworks and methodologies for risk management but at it’s essence, risk management needs to do four key things which you can read about here in detail but key actions are summarized below.

- Risk Identification – What are the things that might happen (especially to my money/investments)?

- Risk Assessment – What is the impact? How much will I lose? How long will it take to recover?

- Risk Action Management Plan – What can I do to prevent this? What can I do if it happens?

- Risk Reporting & Monitoring – How can I make sure it doesn’t happen now or again?

The phrase “risk management” sounds simple enough but the actual follow through can be mind bending. For example, I own a variety of US Treasury bonds and recently credit reporting agency Fitch downgraded US Treasurys. Should I sell the bonds or hold on to them?

Let’s step through the process…

Risk Identification – US Treasurys have been downgraded and there is an elevated risk (albeit small) of further deterioration and/or default.

Risk Assessment – Is this something that can really happen and what is the worst case scenario?

Risk Action Plan – At this point, I will accept the risk but keep watching carefully.

Risk Reporting & Monitoring – Keep an eye on the news, credit agencies, and re-assess periodically.

In this particular example it was easy enough but when dealing with equities or real estate the situation becomes more complex. Bonds are easy to sell with a click of a mouse but real estate is a different story. Equities have derivatives instruments like calls or puts that can be used to mitigate risk so it’s important to have a risk management plan for each type of investment in your portfolio.

In future posts, we’ll dive into how I manage risk in my portfolio matrix.

Because it’s so important here it is again, “The first rule of an investment is don’t lose [money]. And the second rule of an investment is don’t forget the first rule. And that’s all the rules there are.”