The stock market has lost $4 trillion recently and I recently wrote about moving to a collar strategy to protect my portfolio. In that post, I linked to a YouTube video but I thought it would be a good idea to review how I’m using this in my portfolio currently.

Overview

The collar strategy involves taking an equity and selling a call out-of-the-money for as high a premium possible and buying a put with that call premium money. In my case, I will be collaring IWM. I own IWM at various prices from $200 through $240. I wanted to limit my losses on 300 shares that I bought around $214 so I wrote 3 collars.

Initiation

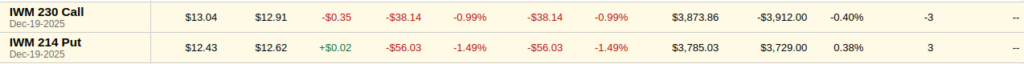

In late February, I entered into the transaction above selling a December $230 call for $3,873.86 and then buying a December $214 put for $3,785.03. This produced a net profit of $3873.86 – $3,785.03 = $88.83.

So while $89 is not anything too exciting, the real trick here is that I bought an insurance policy on these IWM holdings and ending up netting an $89 profit. My gains are limited to IWM going to $230 and my losses are limited to IWM falling to $214. I won’t know which way things will go and I have to wait till December 19 to find out.

If IWM goes above $230 in December I will end up capturing about 7% profits since I bought IWM at $214 and am selling the $230 calls. If IWM drops below $214 in December, I will sell my shares at a pre-determined $214 and limit my losses. In this case, I won’t have gained or lost money except for the dividends I earn between now and then.

Current Status

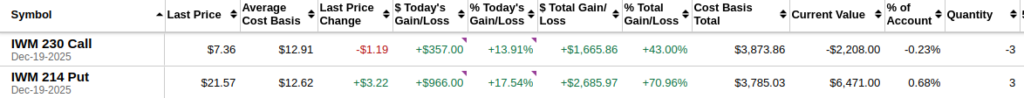

The value of these contracts is going to fluctuate dramatically throughout the year but since the stock market lost $4 trillion, I figured it was prudent to demonstrate how this works in practice. So here’s where I am as of close of business yesterday.

As you can see from the image above, the calls and puts have increased in value because IWM has dropped down to around $200. My $214 puts have gone up in value 70% and my calls have dropped in value. Theoretically, I could close these transactions and bank the profits but the point here is to insure my portfolio through December so I won’t be doing anything but wait and watch.

I have no way of knowing what IWM or the market will do in December. The way things are going now, we may be in a global depression or maybe we’ll be in a new golden age. Either way, for me it’s too much risk so I’ve opted to lock in protections with a guaranteed profit of 7% if things go well or a guarantee of no losses.

Share The Wealth

What do you think? Let me know what risk mitigation strategies you’re using in the comments below.

1 thought on “$4 Trillion In Losses – How My Collar Strategy Keeps Me Safe”

Comments are closed.