Back in April 2024 I wrote a post entitled, “The Gold Bugs, Like Cicadas, Are Out of Hibernation” and the tone of the article was skepticism of where the price of gold was going. In that post I wrote that I have some physical gold and I also own a few gold mining ETFs. I did sell off some of my gold ETFs after they rallied but I still hold shares and physical gold.

I never got around to selling the gold because I was too busy with too many things and it turned out to be a great thing that I didn’t since it’s nearly doubled in value since I wrote that post.

GLD ETF

I don’t know where the price of gold will go from here but huge government debt and deficits, the questionable legality of tariff regime, and potential for geopolitical conflicts all have gold soaring higher.

I hate to miss out on good profits but I also am keenly aware of speculative bubbles popping so how to safely profit from the gold surge?

Option Collars

The way I have decided to profit from gold is to create an option collar around the ETF GLD.

How does this trade work?

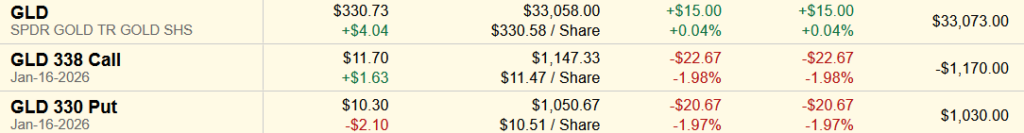

The first step is to buy at least 100 shares of GLD. In this trade I bought 100 shares at $330.58 for a total cost of $33,073 (includes broker fee).

The second step is to SELL out of the money call option for some point into the future. In this case, I chose the January 16, 2026 expiration and the strike price of $338. This means come January 16, 2026 I will be OBLIGATED to sell GLD for $338 no matter how much it is worth. If it’s $400, I have to sell at $338, if it’s $200 I don’t have to do anything and get to keep the GLD shares. For the right to buy my shares at $338, I was paid $1,170 which is money I get to keep no matter what happens.

The third step is to BUY a PUT which gives ME the right to SELL my GLD shares at a particular price for a particular date. In this case, I chose the same January 16, 2026 put strike at $330. Come January 16, if GLD is below $330, I have the right to sell my shares at $330. If GLD drops to $100, I have the right to sell at $330 on Jan 16. For the right to sell my shares at $330, I had to pay a premium of $1030.

So my net profit as of today is $1170-$1030 = $140. That’s money in my pocket no matter what happens.

January 16, 2026 Expiry

So what are the scenarios come January 16?

- GLD is above $338. If this happens, my PUT option is worthless because there is no reason for me to sell my shares at $330 when they’re trading above $338. Because I sold the call option, I am OBLIGATED to sell my shares at $338. So $338-330.58 = $7.42 x 100 shares = $742 in profit + $140 = $882 net profit.

- GLD is below $330. If this happens, my CALL option is worthless because no one would pay $338 to buy GLD if it’s trading below $330. Because I bought the put option, I have the RIGHT to sell my shares at $330. So $330 – $330.58 = -0.58 x 100 = -$58. I will take a $58 loss on the put but I still made $140 so net profit = $82.

- GLD is between $330 and $338. In this scenario, the best thing to do is to repeat the collar strategy and keep going. Neither the PUT nor the CALL are executed so they both expire worthless.

No matter what happens here I will have made money on the trade. Because I am bullish on gold through January, I am strategizing here to that I will come out with $882 profit or 2.7% profit in 132 days (7.6% annualized).

The only thing left to do now is wait till January 16, 2026 and see where GLD lands. Note that this is just one of many trades I am now collaring in this volatile market. I am staying invested in the market but I am buying insurance on all my trades so that I don’t lose any money.

Comments Disabled

Due to spam issues, comments are temporarily disabled.