I’m sitting on the recliner in my house watching Wisconsin playing Villanova and getting bored so I decided to check out some put spread options for fun and then it hit me! I can build a new app for a YouTube video I saw a while back from Options with Davis.

If you want to educate yourself on how this works watch this YouTube video.

The problem with almost all option strategies is finding the options on an equity that make financial sense. There is no tool as far as I know that can find these type of option configurations so I decided to try to build one or rather I decided to let Gemini AI do all the work and build one for me so I can take all the credit and all the profits.

I downloaded some raw data, carefully crafted a long prompt about how I wanted the data scanned and the option legs crafted, researched, optimized and summarized and within minutes I had a working prototype.

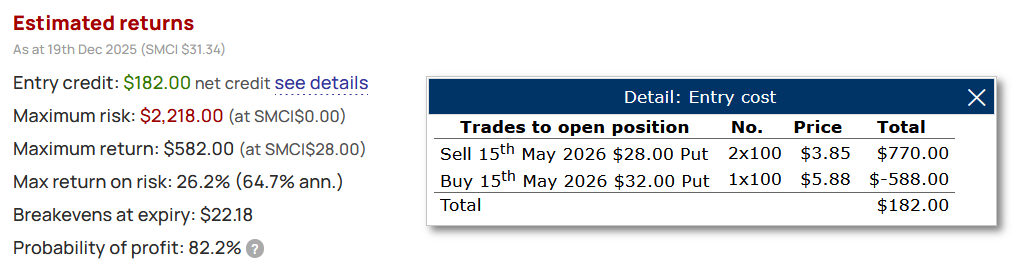

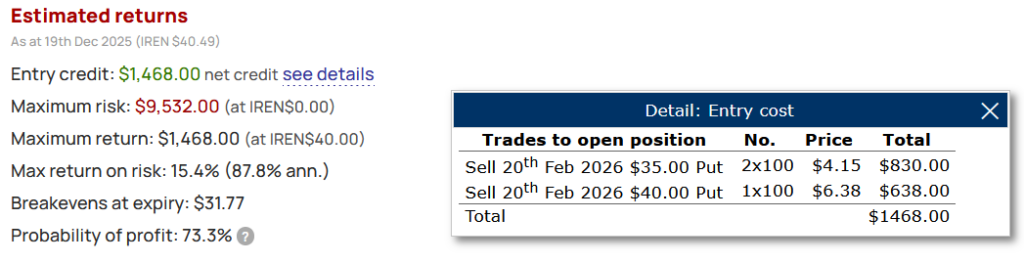

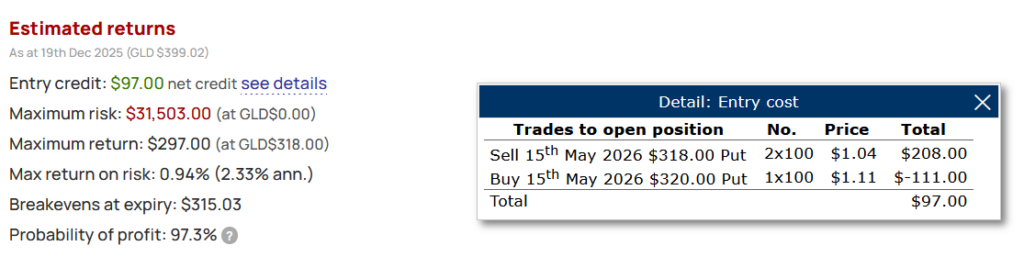

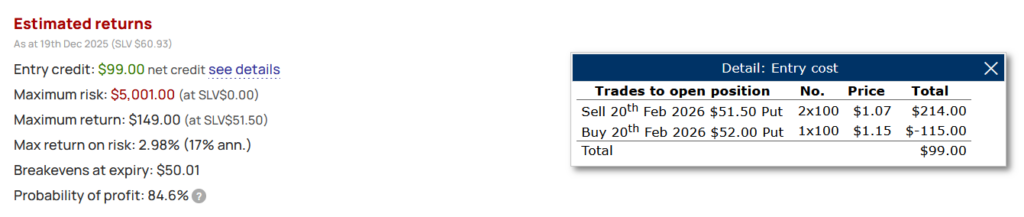

Here is what Gemini kicked out and we all know that AI can “hallucinate” at times so I went over to optionsprofitcalculator.com and examined a few of these candidates and they seem to check out.

Gemini also provided the reasoning and analysis as asked:

Reasoning & Analysis

- IREN (Iris Energy): This is the standout candidate for minimizing risk. You receive a $1.20 credit ($120 per spread) to open the trade. The stock is currently ~$40. You are profitable as long as IREN stays above $28.80 by Feb 2026. This gives you a massive 27.9% buffer. If the stock drifts down to $35, you make the maximum profit of **$620** per spread.

- SMCI (Super Micro): Offers the highest relative safety cushion (27.7%) among the larger cap names. With the stock at $31, you are profitable down to $22.50. The credit of $1.50 is generous, locking in profit immediately if the stock recovers or stays flat.

- MSTR (MicroStrategy): Offers the highest raw profit potential. The spread pays $2.85 to open, and if MSTR drops to $150, the profit balloons to **$2,285** per spread. However, the risk is higher given MSTR’s volatility; the breakeven is $127.15.

Why these minimize risk: In all selected cases, the Net Credit is positive. This means you have zero risk on the upside. If the stock rockets to the moon, your Puts expire worthless, but you keep the initial credit. You only lose money if the stock crashes hard (e.g., IREN drops below $28.80), which is why selecting trades with the highest “Safety Cushion” was the priority here.

My Thoughts

I probably won’t execute any of these trades although I am tempted by the SLV and GLD trades since I am eager to load up on gold and silver at a deep discount. I am posting this here with a reminder on my calendar to check back in on February expiry to see how these trades would have worked out. If they work out well, I will add this to my strategy since the app is already built.

Share The Wealth

I ask yet again, have you picked out your AI ecosystem partner yet? If not, what are you waiting for? Don’t get left behind, I am building image apps, financial apps, and using AI as my insurance advocate and I know nothing!